Coaster freight market summary

Difficult situation on the European grain export market in the season 2024-25 became the main challenge for all coaster freight market parties. Constant pressure on export quotes for wheat and corn, coupled with high domestic prices in the EU, Ukraine and Russia, complicated trade to the limit and forced ship owners to accept unfavorable rules of the game in the second half of the year. Besides, frankly low trade in the metallurgical segment and moderate demand for main types of fertilizers and minerals in the EU countries did not play into the hands of owners. As a result, the outgoing year became one of the worst for small-tonnage owners in the last 10 years. Note that the first half of the year was quite standard in terms of fundamentals, but the market failed to show the autumn upturn, when owners traditionally compensate the losses of the spring-summer period and have an opportunity to create a financial safety cushion for future intermediate or special surveys. The average annual TCE for 3-4k dwt fleet was about $1.4k daily in the Black and Mediterranean Seas, while that for 5-6k dwt vessels slightly surpassed $2k daily, that for 10-11k dwt tonnage slightly exceeded $3.2k daily; these are the worst levels in the last 4 years. Meanwhile, over the last 10 years, owners’ earnings were lower only in 2016 and 2020 (however, the OPEX back then was 20-25% lower). It should be noted that this year, unlike 2022 and 2023, TCEs for shipments from Ukrainian ports were virtually in line with owners’ earnings in case of shipments from neighboring Romania, Bulgaria and Turkey

. In 2024, only trips from Russian ports remained premium, but even this segment no longer shows such a big difference as before (just +$0.2-0.4k daily). In North Europe, the earnings of ship owners turned out to be significantly higher by the end of the year, which, however, is quite typical for the last few years. However, this area also showed a considerable decline compared to the previous year. Thus, the average TCE for 3-4k dwt ships operating from ports of the lower Baltic or the Continent reached 2k daily, that from Russian ports - about $2.6k daily (which is 25% and 50% lower than in 2023, respectively). As for the Azov Sea, the earnings of sea-river owners with vessels of just over 3k dwt nearly halved y-o-y, from $3.9k daily to $2.07k daily, but we should recall that 2023 was the second-best year in terms of daily earnings (after the most successful 2022). Besides, with Turkey’s wheat import restrictions in place throughout the fall, the result for ship owners could have been much worse.

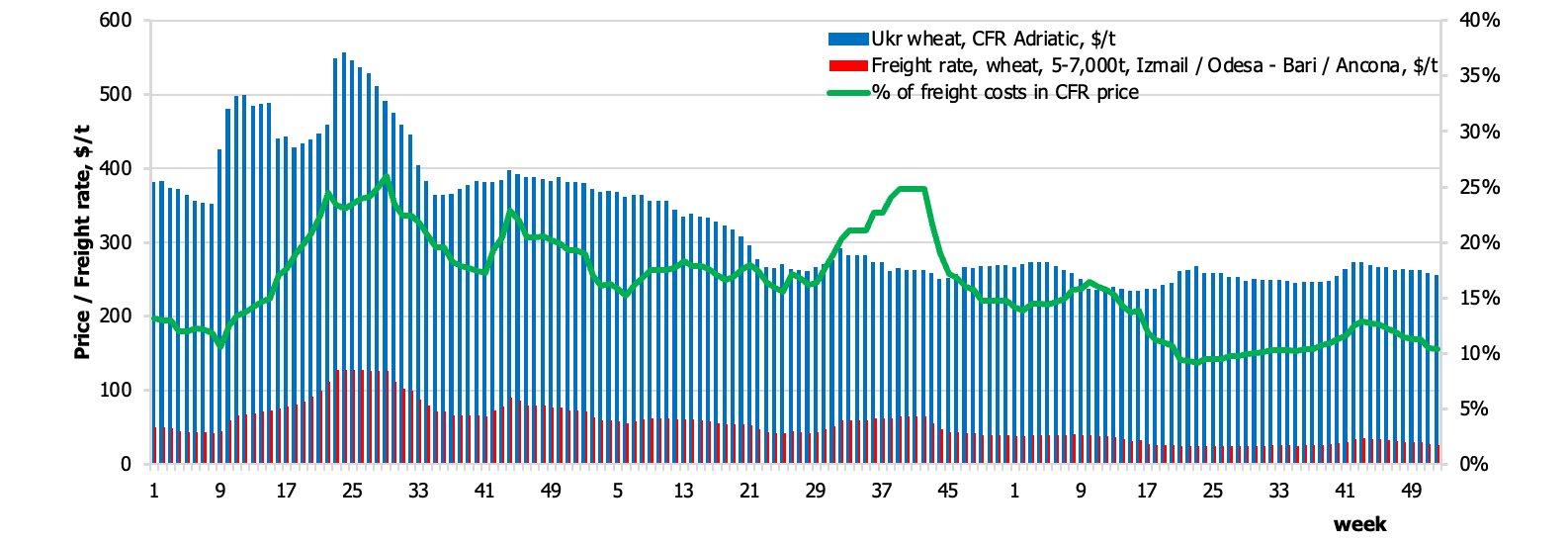

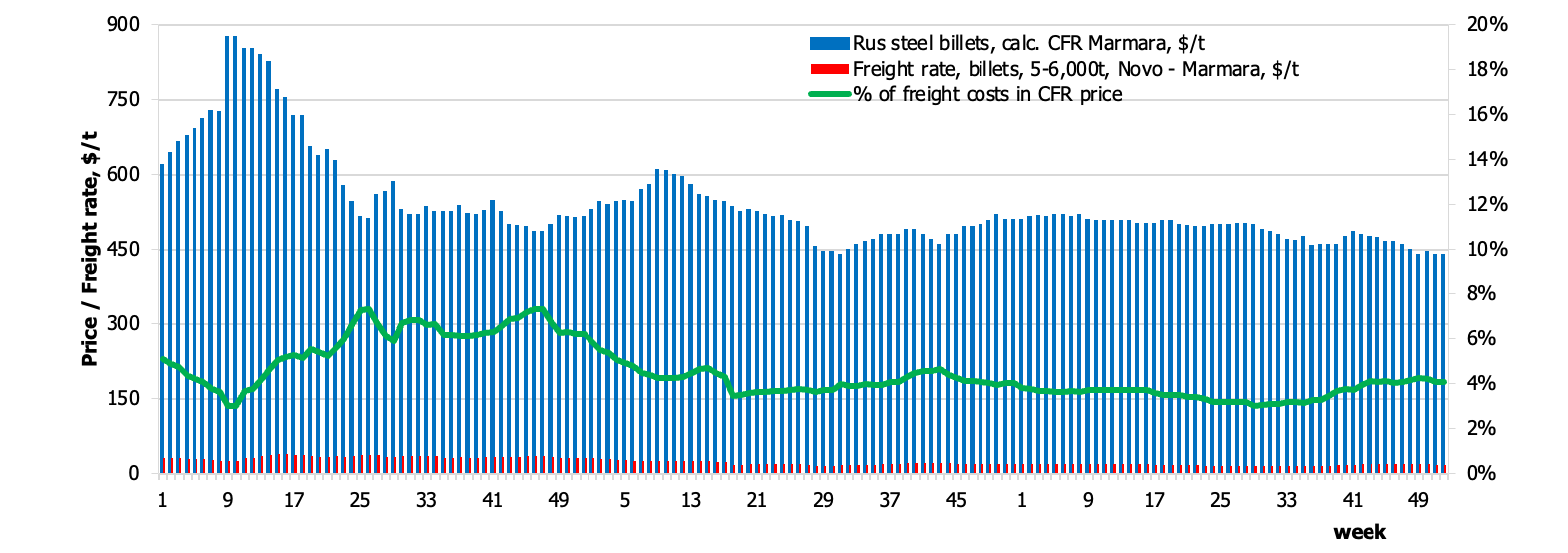

In 2024, charterers’ costs for shipping by small-tonnage fleet decreased by $4-8/t on long-haul routes and by $2-4/t on short-haul directions (or by 15-25%) both in the south and north of Europe, while rates for grain shipments from Ukraine have dropped by more than $20/t. The situation for charterers is not so unambiguous, considering the dynamics of export prices for main cargoes. Thus, the share of transportation costs of traders shipping grain from Ukraine to Italy or North African countries decreased from 18% to 12%, but in case of similar shipments from the ports of Romania and Bulgaria, the share of transportation costs even inched up due to a decline in prices for European wheat by $50/t on average (or by 18-19%) over the year. The share of transportation costs of Russian square billet charterers declined from 4.2% to 3.6% y-o-y (CFR Marmara price dropped by about 10%). As for fertilizers, for example, the share of freight costs for Egyptian urea shipped to the EU fell only slightly, from 7.4% to 6.8%, as lower freight rates were partially offset by a decrease in CFR SpanMed/Italy prices from $415/t to $365/t.

Ukrainian wheat: weight of freight in CFR Adriatic price in 2022-2024

Ukrainian wheat: weight of freight in CFR Adriatic price in 2022-2024

Russian steel billets: weight of freight in CFR Marmara price in 2022-2024

Russian steel billets: weight of freight in CFR Marmara price in 2022-2024

Handysize and Supramax freight market summary

The year 2024 was generally as underperforming for Handysize and Supramax/Ultramax owners as 2023 (especially compared to 2021 and 2022). Average annual TCEs for Handysize round-voyages from USG and ECSA ports increased from $8.38k daily to $9.5k daily by the end of the year, while earnings of owners of 30-32k dwt fleet operating on inter-Med voyages declined to $7.2k daily (-10% compared to 2023).

TCT rates and corresponding TCEs for Supramax tonnage working on transatlantic and front-haul routes added some 8-12% in 2024. Thus, the average TCT rate bss dely APS USG redel Spore/Japan inched up from $20.5k daily to $22.5k daily, while front-haul levels ex Mediterranean area or the Continent grew from $17.5-18.5k daily to $20-21k daily.

As for the Eastern Hemi, the weighted average RV TCE for Supramax vessels increased slightly more significantly compared to the Atlantic Ocean, namely from $9.8k daily to $12.9k daily, which is higher than in 2017-2020, but significantly lower compared to 2021 and 2022.

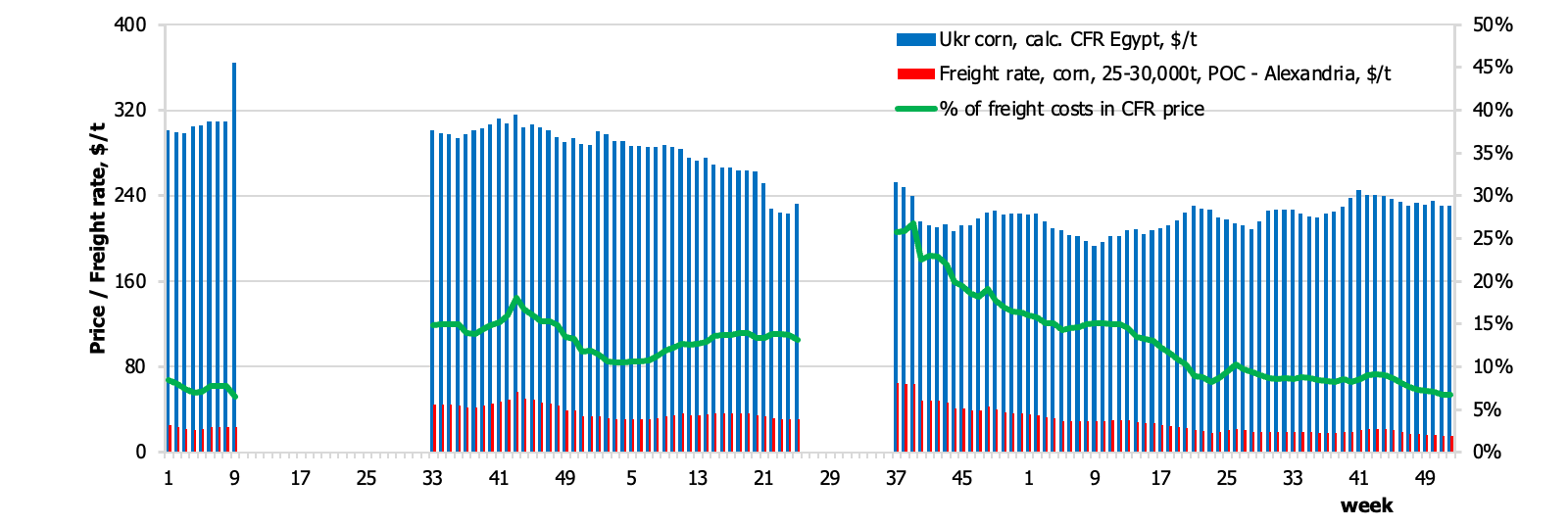

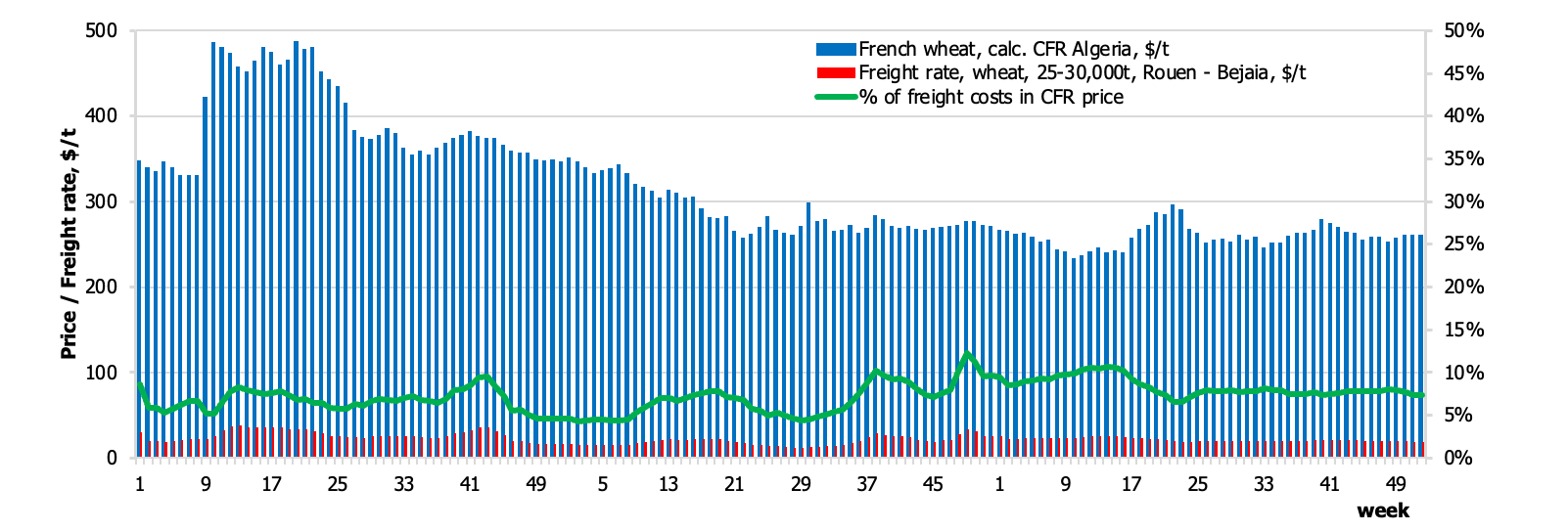

Given minimal changes in average annual Handysize and Supramax voyage-basis rates, the share of freight costs for grain traders showed an upturn by the end of 2024 due to a 22-25% decrease in export prices for wheat, corn and soybeans. For instance, the share of freight costs for the EU wheat shipped in 25-30,000 t lots from France or CVB to Algerian or Tunisian ports grew from 6-7% to almost 8%. Accordingly, the share of freight costs for US corn carried in Supra-lots to China inched up from 17.5% in 2023 to more than 20% in 2024, while that for Brazilian soybeans rose from 10.7% to 14.2%. In contrast, the share of freight in CFR EMed prices for Ukrainian wheat and corn fell from 16% to 11%, despite a significant drop in export prices. This decline is referred to the fact that premiums for shipments from Ukraine almost disappeared in 2024: transportation costs to Iskenderun or Alexandria dropped from $37/t on average in 2023 to $23/t in 2024.

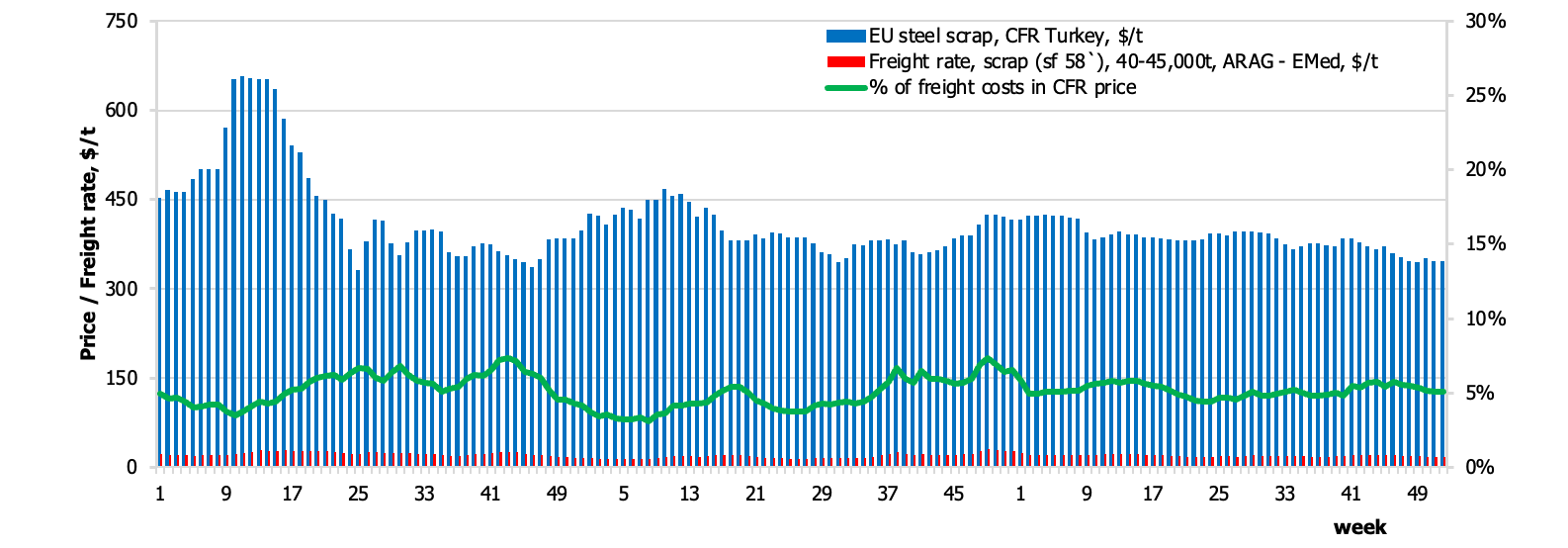

As for scrap traders, the share of freight costs for EU steel scrap shipped in Handymax/Supra lots towards Turkey

increased from 4.7% to 5.1% due to almost unchanged scrap export prices and an upturn in freight rates by $1.3/t (+7%) in 2024. Finally for this chapter, ISM discovered shipping costs of urea charterers. With the drop in urea prices C&F Brazil by 3-4% and an increase in freight rates by 5-7% in 2024, the share of freight costs for urea carried in 25-30,000 t lots from North Africa and the Baltic States rose from 7.7% to 8.2%.

Ukrainian corn: weight of freight in CFR Egypt price in 2022-2024

Ukrainian corn: weight of freight in CFR Egypt price in 2022-2024

French wheat: weight of freight in CFR Algeria price in 2022-2024

French wheat: weight of freight in CFR Algeria price in 2022-2024

Baltic urea: weight of freight in CFR Brazil price in 2022-2024

Baltic urea: weight of freight in CFR Brazil price in 2022-2024

EU scrap: weight of freight in CFR Turkey price in 2022-2024

EU scrap: weight of freight in CFR Turkey price in 2022-2024

Panamax and Kamsarmaxfreight market summary

Weighted average front-haul rates for Panamax/Kamsarmax fleet declined from $29.3k daily in 2023 to $27.5k daily in 2024, while levels for TARVs are hovering at $11.7-11.8k daily this year against $11.9-12k daily in 2023. In the Eastern Hemi, the Panamax weighted average TCE bss RV grew from $8.2k daily to $10.7k daily in 2024.

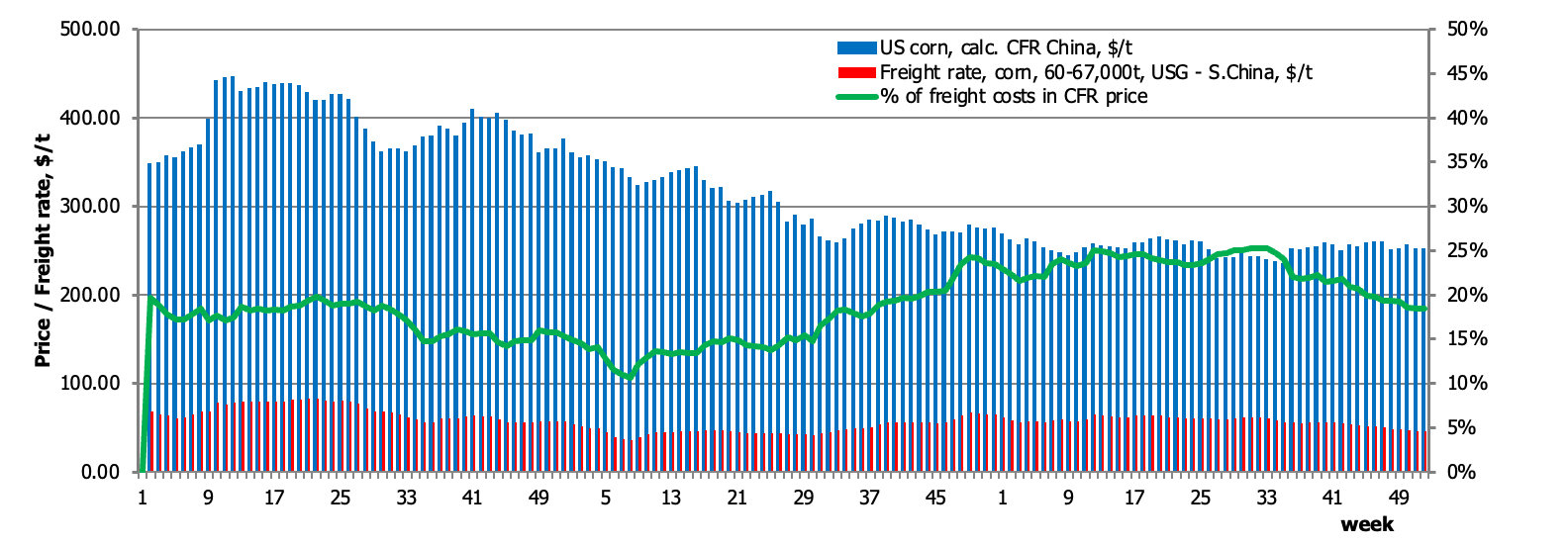

As for grain exports by Panamax/Kamsarmax tonnage, the freight share in CFR China prices for US and Brazilian corn increased from 17% to 23% and from 13.5% to 17%, respectively, with freight rates rising by $4.5/t and $7.5/t (+15-20%) and export prices falling by about $50/t (-15-18%). The share of freight in soybean prices increased slightly less significantly only because it is initially lower given that soybeans are almost twice as expensive as corn. As for Ukrainian and Russian grain, transportation costs from the Black Sea to Asia remained almost the same as in 2023, as the 10% decrease in freight rates was offset by a 10-15% decline in export quotes for wheat and corn.

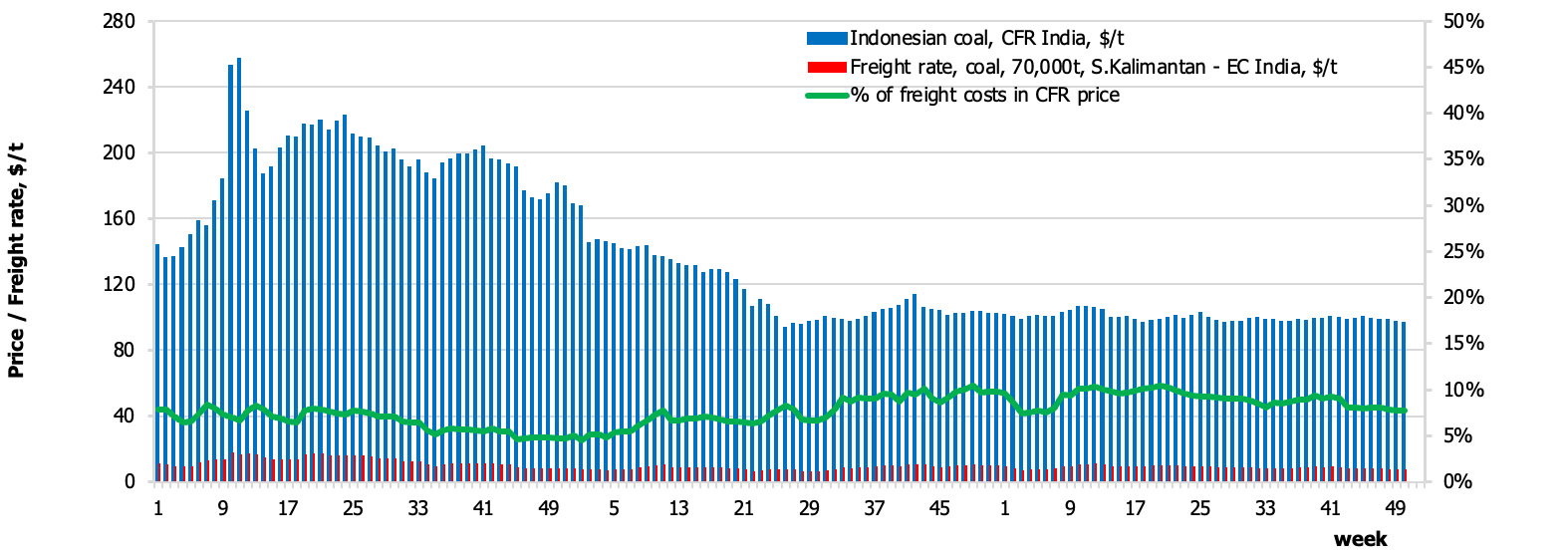

Speaking of other cargoes, the share of freight costs for coal trades increased in Asia. For example, voyage-basis freight rates ex Indonesia to India declined by less than $0.5/t (-3-4%), but the share of these costs in the C&F India price has grown from 7.5% to 8.8% due to a 13% drop in average annual export prices for coal in Asia.

Indonesian coal: weight of freight in CFR India price in 2022-2024

Indonesian coal: weight of freight in CFR India price in 2022-2024

US corn: weight of freight in CFR China price in 2022-2024

US corn: weight of freight in CFR China price in 2022-2024

Capesize freight market summary

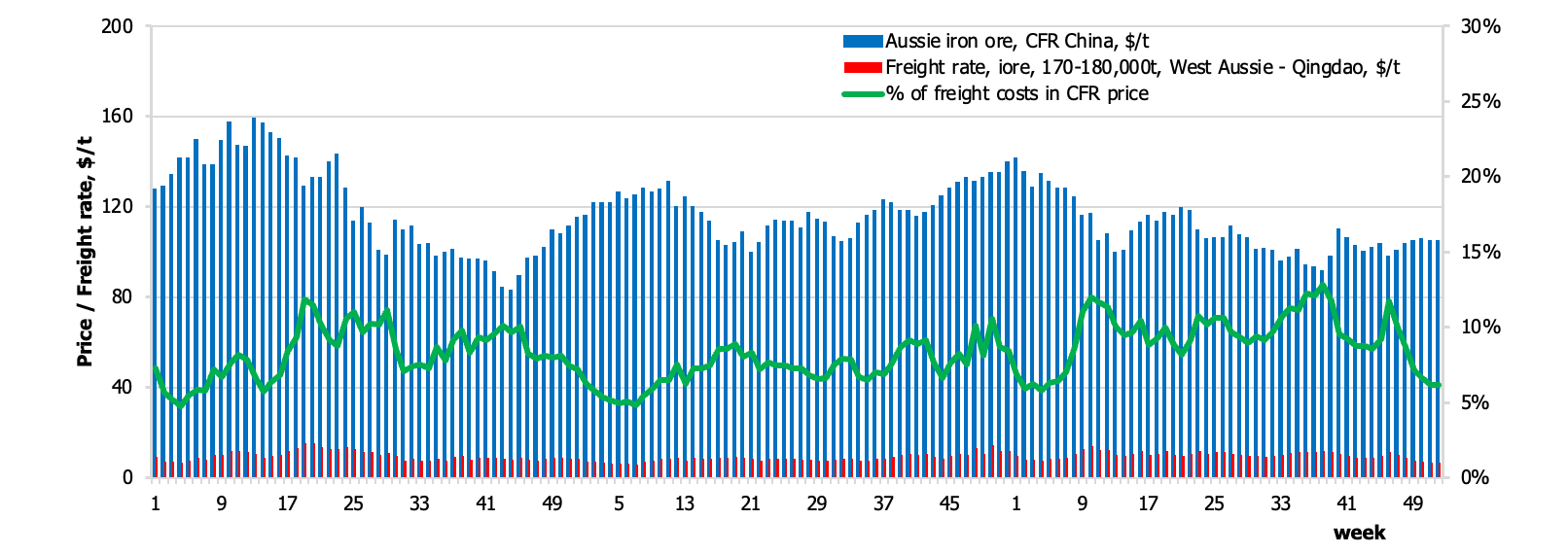

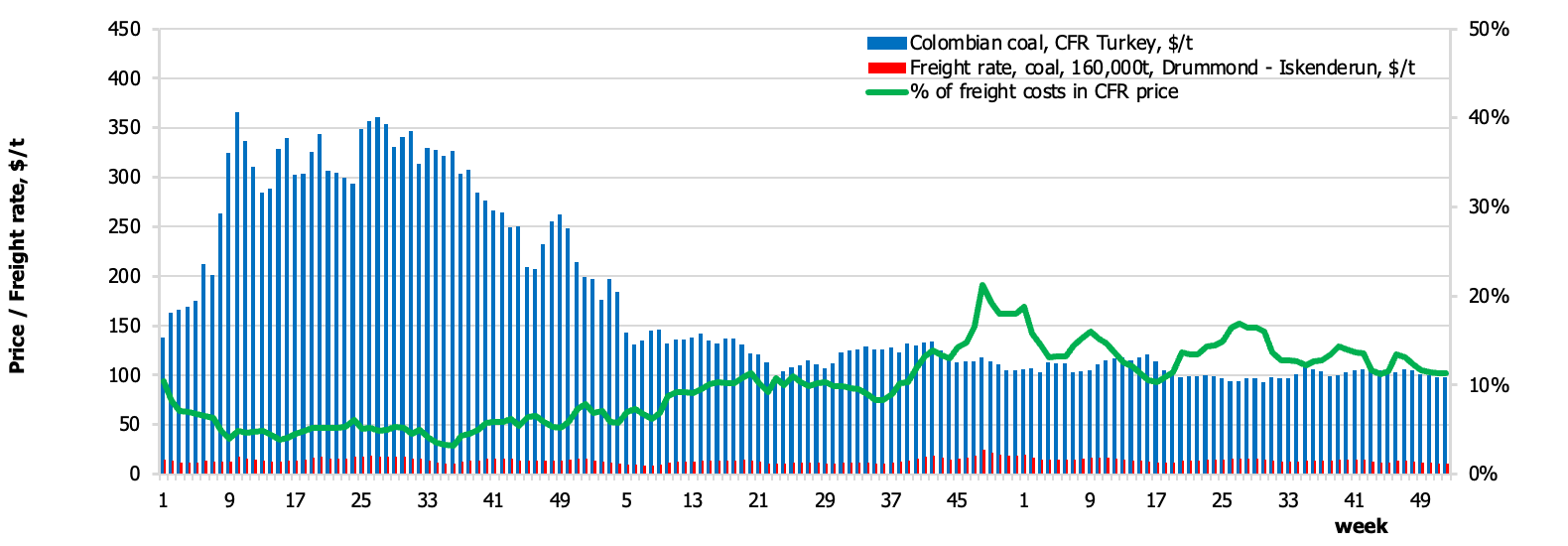

Capesize freights inched up by $4-5/t in 2024 (+17-20%), while transatlantic and inter-Pacific transportation costs added $0.5-1.5/t (+5-10%).

The share of freight costs for coal charterers in the Atlantic Ocean even inched up from 10-11% to 13-14% amid a decline in C&F prices in the EU and Turkey

. The share of freight costs of iron ore charterers also rose in 2024, namely from 7.3% to 9.3% for Australian exports and from 17.7% to 23.2% for Brazilian exports. Besides, C&F China iron ore prices dropped from $118.1/t to $109.5/t, putting additional pressure on the freight share.

Aussie iron ore: weight of freight in CFR China price in 2022-2024

Aussie iron ore: weight of freight in CFR China price in 2022-2024

Colombian coal: weight of freight in CFR Turkey price in 2022-2024

Colombian coal: weight of freight in CFR Turkey price in 2022-2024