The ongoing war between Russia and Ukraine with escalation directly at sea, permanent deterioration in the Gaza Strip and the Middle East, growing political tensions between the US and China, and turbulence in US-EU relations have all contributed to unfavorable and unstable global trade in the outgoing year of 2025. In turn, the latest tightening of environmental requirements and expansion of the SECA zone, the increase in EU ETS tariffs (the next round of which is expected on January 1, 2026), and the growing number of countries requiring the application of EWRI rates have become a challenge for owners of dry cargo fleet. And yet, how difficult was 2025 for the freight market as a whole, and also for its segments, tonnage groups, and players? As is tradition, ISM sums up the outgoing year by using the data and its own exclusive freight statistics accumulated during its more than 15-year presence on the market.

Coaster freight market summary

After a very difficult year for the Black Sea and European wheat markets in 2024, the year 2025 turned out to be slightly more successful in terms of both export volumes and prices which rose by about 10% compared to the weighted average for 2024. On the other hand, harvest delays and worsening logistical and energy problems in Ukraine in Q4 2025 led to a significant reduction in corn exports compared to October-December 2024. As a result, only soybean shipments perked up significantly in the small-tonnage shipping segment, becoming a real lifeline for small-tonnage owners in the Black Sea this year, ISM experts believe. However, the earnings of Black Sea shipowners showed just insignificant increase in 2025 – approximately $120/day or 6% for 5-6k dwt vessels and almost $300/day or 10% for ships of 10-11k dwt. Note that earnings remained virtually unchanged in the Mediterranean Sea; that was due to the increase in bunker prices triggered by the Mediterranean Sea becoming part of the SECA zone.

Speaking of owners working ex Ukrainian ports, the corresponding TCEs turned out lower compared to shipments from neighboring Romania and Bulgaria for the first time since the start of the Russian-Ukrainian war (not to mention Russia, where many charterers still pay a certain premium). ISM attributes this to the rise in transit costs and new customs procedures in Sulina, as well as a general decline in cargo flows from Ukraine (primarily due to a corn shortage) amid a fairly stable and established pool of shipowners focused on working from Ukraine (mainly consisting of overaged Arab vessels). Thus, TCEs for 5-6k dwt vessels sailing from Ukraine did not even reach $1.9k daily, which is the lowest in the last 5 years. However, it is necessary to highlight an important nuance, namely the decreased number of ballast trips when operating on the Black Sea-EMed route and actually a much higher TCE than estimated. The fact is that in 2H 2025, many players stopped considering the cargo traffic from EMed to the Black Sea as a so-called "return traffic" due to steady exports of various minerals, fertilizers and even steel products from Egypt, Turkey and Tunisia to the Black Sea.

Market conditions clearly deteriorated in North Europe. With owners being able to achieve much more favorable results in 2023-2024 due to the outflow of the tramp fleet, the year 2025 brought a decline in TCEs for 3-4k dwt vessels operating in the Continent and the Lower Baltic (down $300-400 daily or 15-20% compared to 2024). Meanwhile, the earnings of owners working from Russian Gulf of Finland ports did not fall compared to last year (oddly enough, the premium for such shipments obviously showed an even bigger increase).

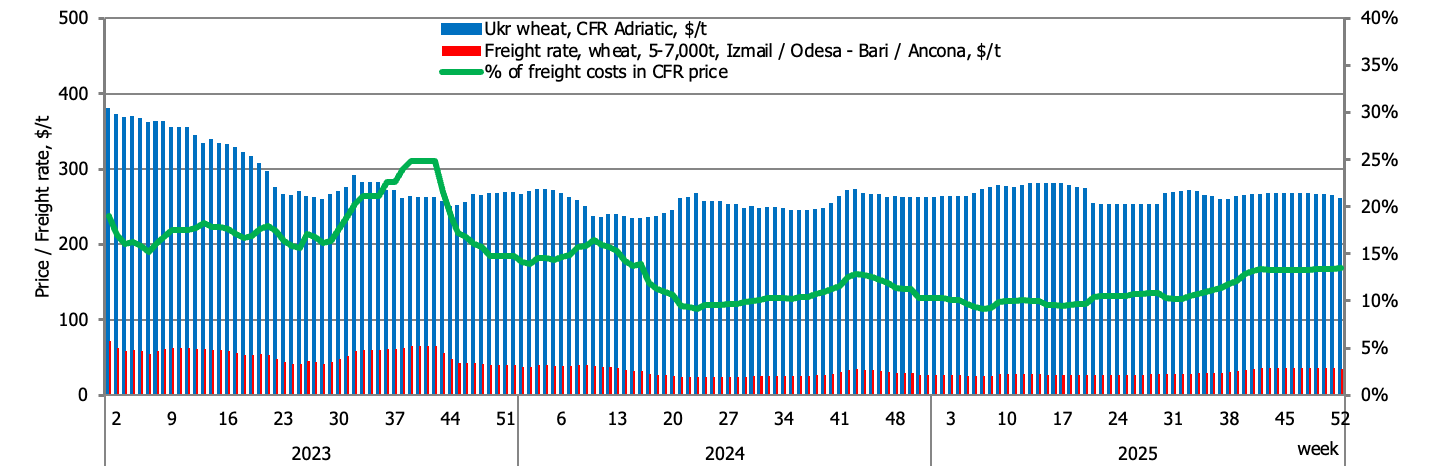

As for charterers' expenses, grain traders working with small cargo lots ex Ukraine managed to reduce the weighted average rate for transportation of 5-6,000 t of wheat, soybeans or corn by just over $1/t (down 3% year-on-year). At the same time, considering the increased export quoted, the share of freight costs in the CFR Adriatic or EMed price fell from 11% to just under 10% for wheat and from almost 13% to 11% for corn. Meanwhile, rates for a similar shipment of wheat from Constanta or Varna to the Mediterranean rose by $0.5-0.7/t, with the share of freight costs in the CFR price staying virtually unchanged (9.5% in 2025 vs. 9.2% in 2024), as such a slight rate upturn was completely offset by higher export quotes.

In 2025, charterers of Russian square billets were paying $17.5/t on average for transportation of 5-6,000 t of cargo from Novorossiysk to Marmara compared to $17.6/t last year. Meanwhile, the share of freight costs in the CIF Marmara price rose from 3.6% to 4% owing to a decline in the average annual price for square billets in Turkey from $490/t to $435/t.

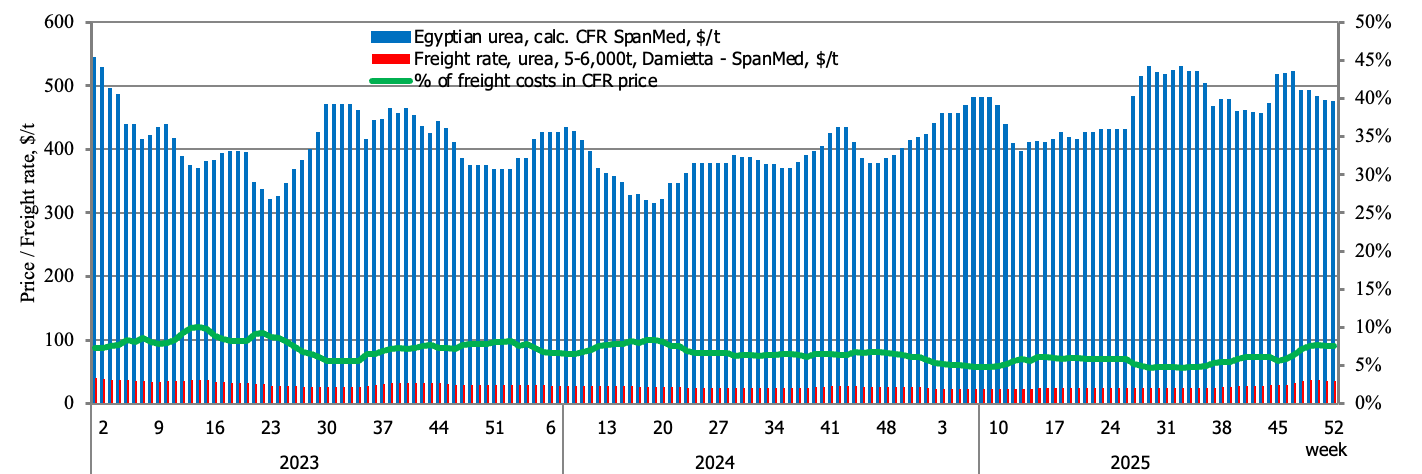

Urea was another cargo that provided solid support to small-tonnage owners. Rates for a typical shipment of 5-6,000 t of urea from Egypt to Spain or Italy remained virtually unchanged at the end of 2025, while the share of freight costs in the CFR SpanMed price fell from 7% to 5.6% due to an impressive drop in export quotes from $465/t to $383/t over the year.

Focusing separately on the sea-river segment, the weighted average TCE for sea-river vessels of about 3k dwcc in the Azov Sea barely reached $1.6k daily at the end of 2025, down almost $500 daily or 23% from last year (and much lower than in 2022 and 2023). At the same time, such a serious decline in the economy of voyages did not bring any special dividends to local charterers as the average annual share of freight costs in the price for Russian wheat bss CIF Marmara stepped down quite insignificantly, from 13.5% to 12.2% (even despite a slight upturn in these prices at the end of 2025). This is due to a rise in the average trip duration caused by multi-day downtimes in Kerch throughout the second half of the year, which, in fact, predetermined the decline in TCEs amid fairly high freight rates.

Coaster/Minibulker average daily earnings (TCE) on main shortsea routes in 2023-2025

Coaster/Minibulker average daily earnings (TCE) on main shortsea routes in 2023-2025

Ukrainian wheat: weight of freight in CFR Adriatic price in 2023-2025

Ukrainian wheat: weight of freight in CFR Adriatic price in 2023-2025

Russian steel billets: weight of freight in CFR Marmara price in 2023-2025

Russian steel billets: weight of freight in CFR Marmara price in 2023-2025

Egyptian urea: weight of freight in CFR Spain price in 2023-2025

Egyptian urea: weight of freight in CFR Spain price in 2023-2025

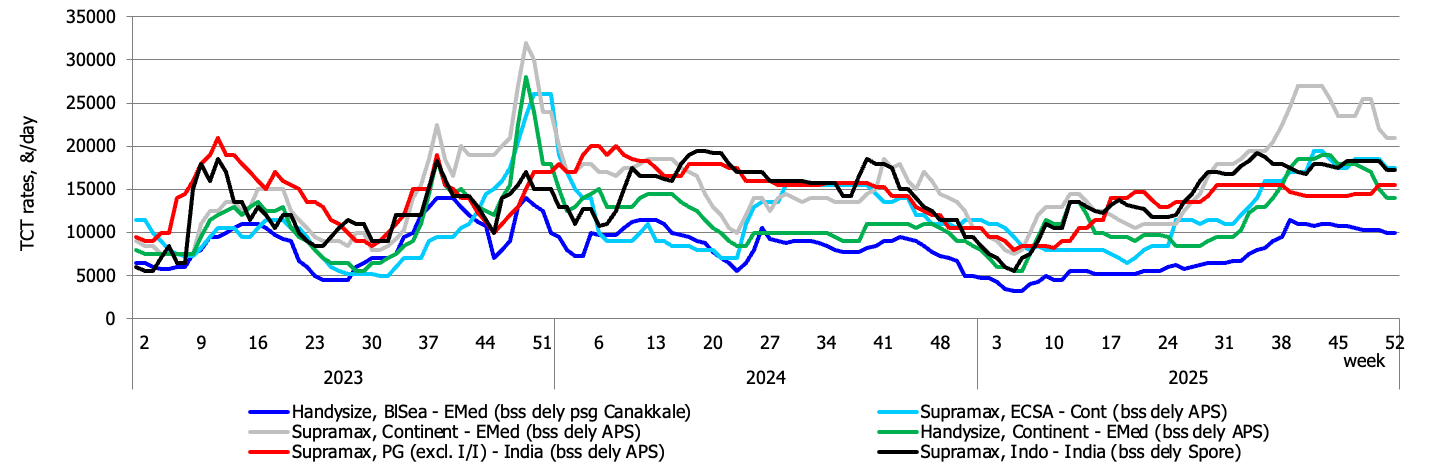

Handysize and Supramax freight market summary

Average transatlantic RV TCEs for standard Handysize vessels fell from $9.5k daily to $8.8k daily in 2025 (down 7.4% y-o-y), which is, however, slightly higher than in 2023. The same indicator for Supramax fleet remained slightly below $13.5k daily, which is virtually in line with 2024. At the same time, fronthaul TCTs for Supramax/Ultramax vessels working from USG and ECSA declined by just over $2k daily in 2025, while those from the Continent dropped by almost $4k daily and those from the Mediterranean by more than $6k daily (a decrease of 25% and even larger).

The average annual TCE for Handysize vessels on intermed routes dropped from $7.2k daily to $5.85k daily, which is only 10-15% higher than OPEX. However, this average figure implies a significant spread in the figures for overaged Arabian vessels working with Ukrainian grain and for the more expensive fleet that does not call at Ukraine and Russia. Therefore, we should hardly say about an unequivocal deterioration in the market picture for owners at the end of 2025.

As for the Eastern Hemi, the weighted average RV TCE for Supramax vessels sagged from $12.9k daily to $11.1k daily, which is higher than in 2023, but significantly lower compared to 2021 and 2022.

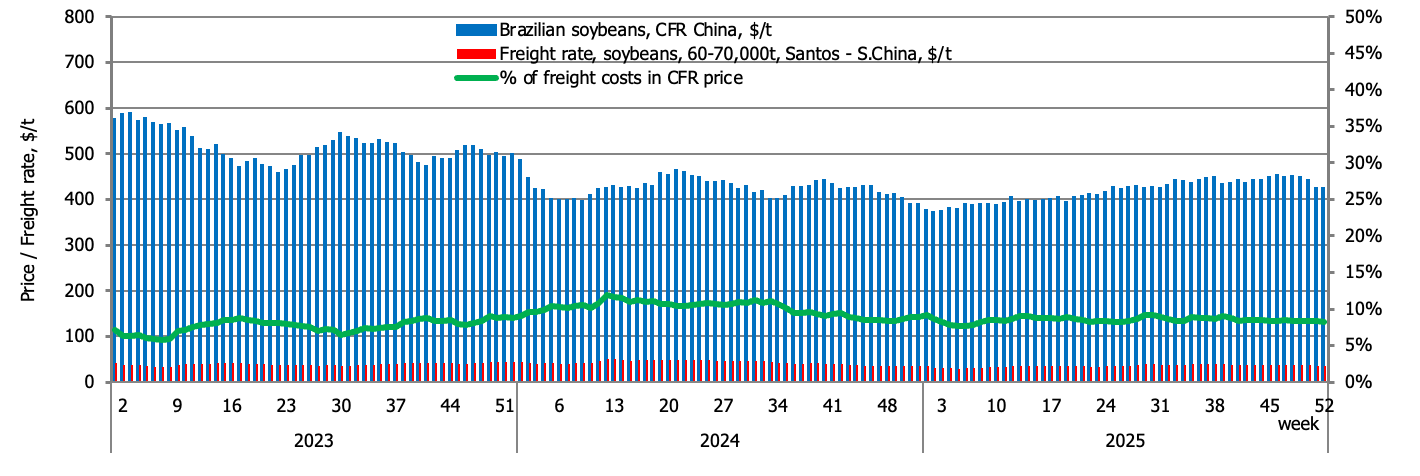

The costs of Brazilian soybean shippers for transportation of 50,000 t of the cargo to China declined by almost $3/t or 6.7% at the end of 2025, while the share of freight costs in CFR China prices did not drop as significantly (only from 9.2% to 8.9%) due to a slight decrease in export quotes. The share of freight costs for charterers of similar US corn shipments to China decreased much more noticeably, from 21.8% to 18.9%, as the decline in freight rates by almost $5/t coincided with a slight increase in the weighted average export prices for US corn in 2025.

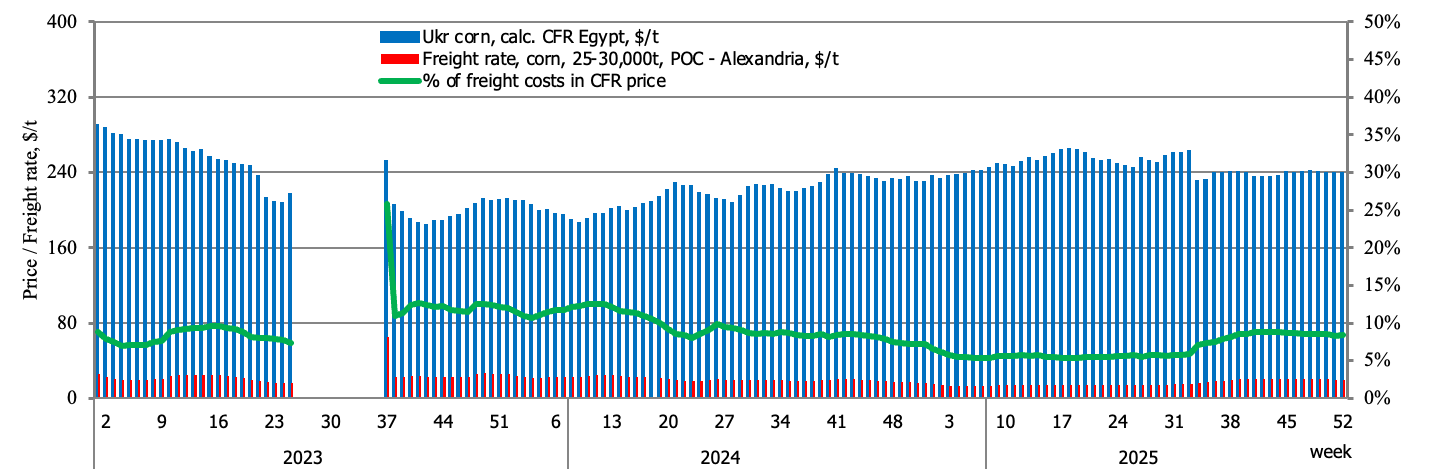

An about 25% reduction in average annual freight rates for Handysize transportation of Ukrainian and Russian grain to Egypt or Turkey allowed traders to cut the share of freight costs in CFR EMed prices from 11% to 7% for corn shipments and from about 9.5% to 6.2% for wheat shipments. At the same time, the share of freight costs for European grain shippers from CVB decreased a far less considerably (from 6.9% to 5.9%), as the average annual cost of such shipments declined only by $1.3/t or 8% year-on-year. Moreover, the share of freight in the CFR Algeria or Morocco price for European wheat inched up, as the weighted average Handysize transportation cost of French grain to North Africa rose by 3% in 2025, while export prices grew from $244/t to $261/t bss CFR Algeria/Morocco.

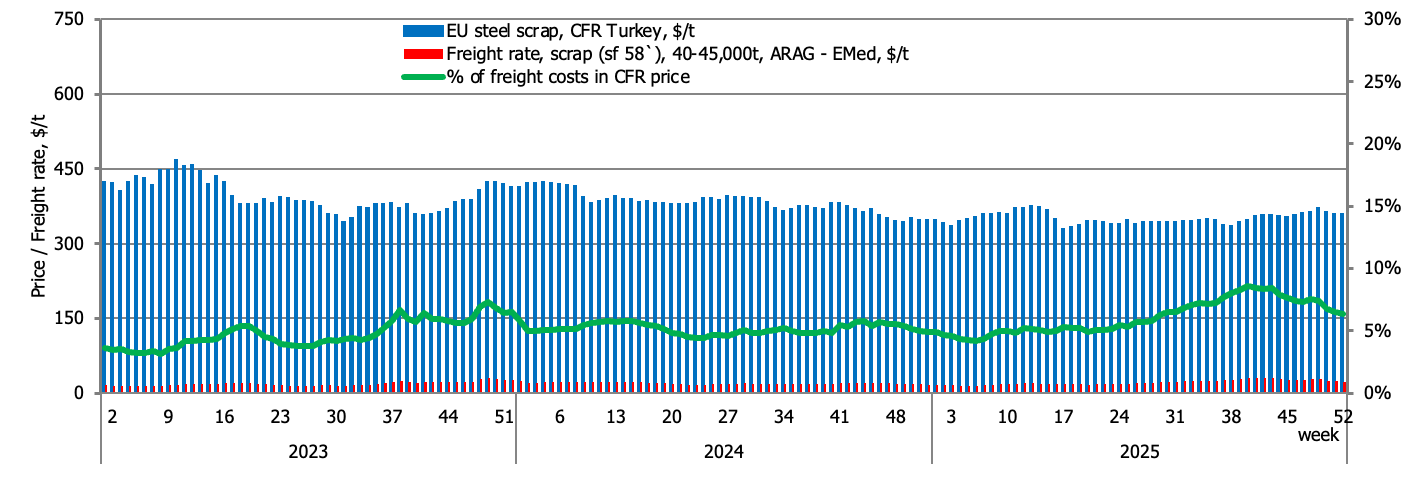

The share of Handymax/Supramax freight costs of European steel scrap exporters when delivering to Turkey increased from 5.1% to 6.1% at the end of 2025, as the decline in CFR Turkey quotes from $383/t to $351/t (down almost 8.5% y-o-y) was compounded by an increase in the average annual freight rate from $19.8/t to $21.3/t (up 7.6% y-o-y).

Time-charter-trip rates for Handysize & Handymax/Supramax vessels in 2023-2025

Time-charter-trip rates for Handysize & Handymax/Supramax vessels in 2023-2025

Ukrainian corn: weight of freight in CFR Egypt price in 2023-2025

Ukrainian corn: weight of freight in CFR Egypt price in 2023-2025

French wheat: weight of freight in CFR Algeria price in 2023-2025

French wheat: weight of freight in CFR Algeria price in 2023-2025

EU scrap: weight of freight in CFR Turkey price in 2023-2025

EU scrap: weight of freight in CFR Turkey price in 2023-2025

Panamax and Kamsarmaxfreight market summary

Weighted average fronthaul rates for Panamax/Kamsarmax fleet keep going down for the fourth year in a row, to $23.3k daily in 2025 compared with $27.5k daily in 2024. In the meantime, levels for TARVs inched up (similar to the previous year, by the way) to $12.2-12.3k daily against $11.7-11.8k daily in 2024. In the Eastern Hemi, the Panamax weighted average RV TCE dropped from $10.7k daily in 2024 to $10.3k daily in 2025, which is still about 20% more than in 2023.

As for Panamax/Kamsarmax grain exports, the freight share in CFR China prices for US and Brazilian corn dropped from 24.2% to 19.2% and from 16.7% to 13.9%, respectively, with freight rates falling by $13.5/t and $7.4/t (down 17-22% y-o-y) and export prices staying almost unchanged compared to 2024. The share of freight in soybean prices dropped less significantly because it is initially lower given that soybeans are almost 1.5 times more expensive than corn. In addition, the weighted average cost of soybeans decreased slightly over the year (down 3-4%). Meanwhile, the gradual decline in EWRI for shipments from Ukraine and Russia triggered a decrease in transportation costs of large grain shipments to Asia from the low-$50s/t to the very high-$30s/t, which significantly reduced their share in the price of corn and wheat, especially considering the rise in Black Sea grain prices in 2025.

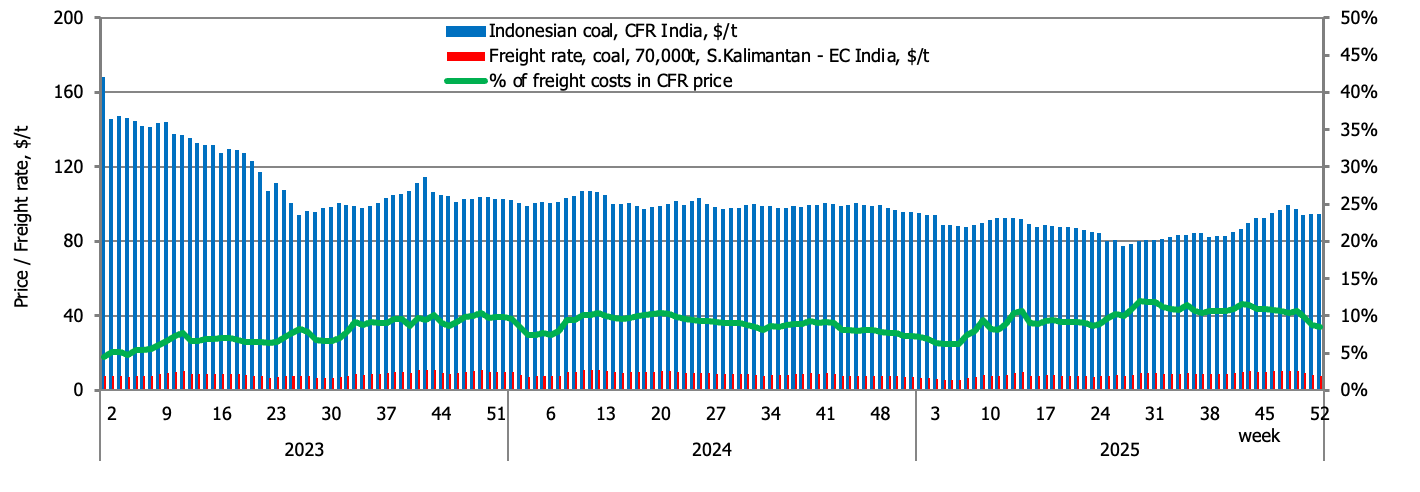

Speaking of other cargoes, despite a decrease in the average annual freight rate for shipments of Indonesian coal to India from $8.9/t to $8.4/t, the share of freight costs for coal traders increased from 8.9% to 9.5% amid a significant decline in coal prices in 2025 ($86.9/t in 2025 against $99.5/t in 2024).

US corn: weight of freight in CFR China price in 2023-2025

US corn: weight of freight in CFR China price in 2023-2025

Brazilian soybeans: weight of freight in CFR China price in 2023-2025

Brazilian soybeans: weight of freight in CFR China price in 2023-2025

Indonesian coal: weight of freight in CFR India price in 2023-2025

Indonesian coal: weight of freight in CFR India price in 2023-2025

Capesize freight market summary

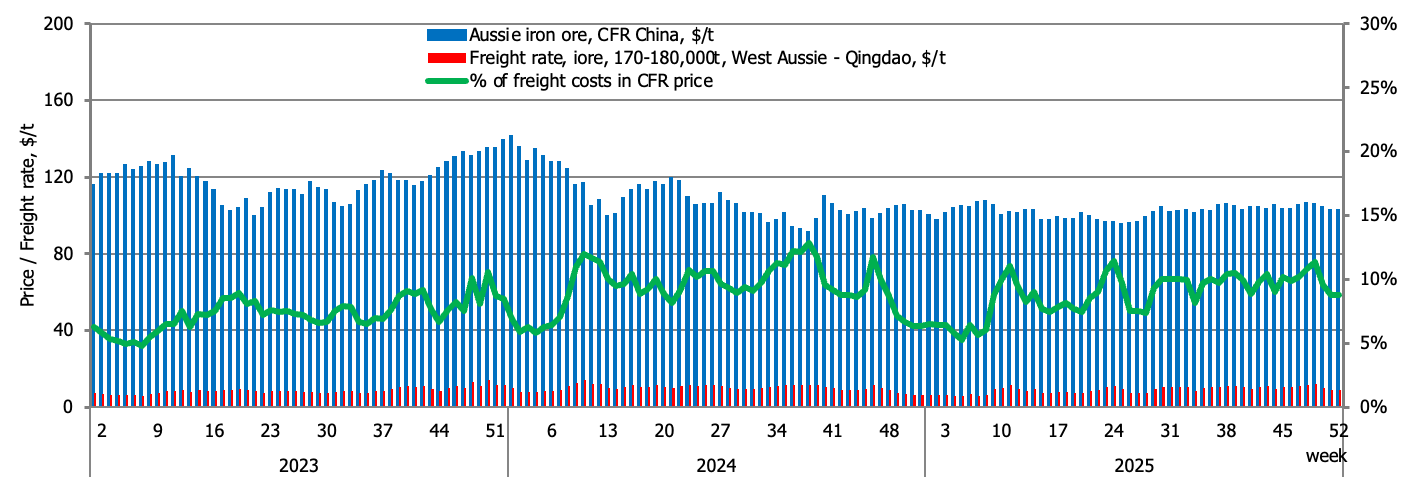

Capesize voyage-basis rates for the usual Brazil-China iron ore route declined from $25/t to $21.6/t (down 14%), while transatlantic rates sagged by $0.2-0.4/t. Transportation costs of Australian ore and coal decreased by $0.9-1.1/t (down 9.1% on average), while those ex South Africa dropped by $1.5-2/t.

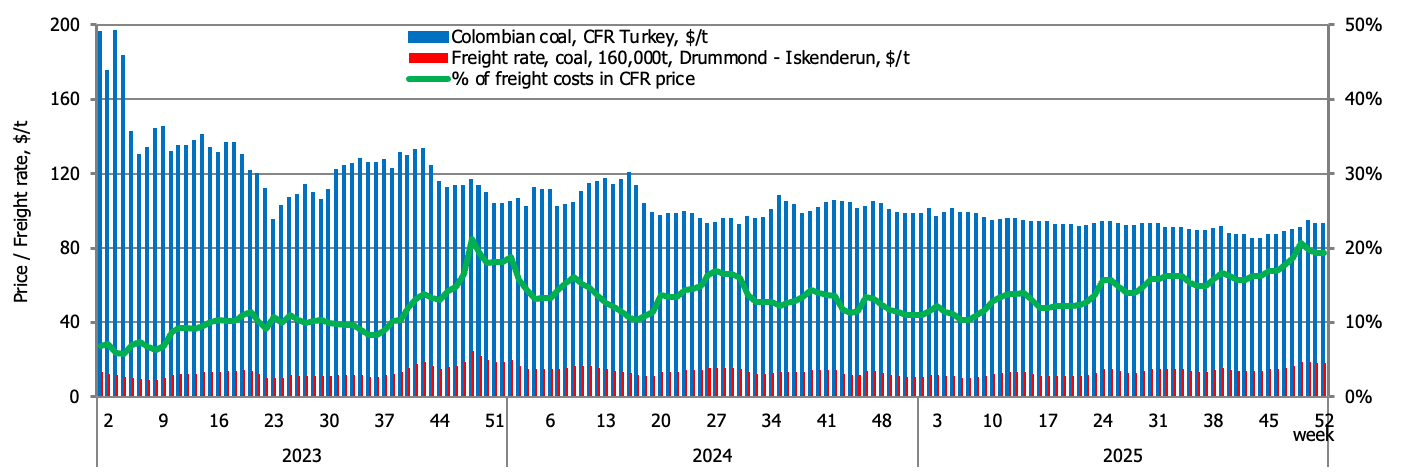

Despite a reduction in freight rates, the share of freight costs for US and Colombian coal charterers in the Atlantic Ocean rose from 13.4% to 14.5% amid an approximately 10% y-o-y decline in C&F prices in the EU and Turkey.

Meanwhile, the share of freight costs of major iron ore charterers decreased from 9.2% to 8.8% for Australian exports and from 23.2% to 21.3% for Brazilian shipments in 2025. Iron ore prices dropped from $109.5/t to almost $102/t, partially offsetting the impact from decreased freight rates. We should also note a significant plunge in transportation costs for Ukrainian iron ore shippers, primarily due to lower EWRI rates for corresponding port calls. The average transportation cost of 170-180,000 t of iron ore from Pivdennyi to China fell from almost $40/t in 2024 to $26.3/t at the end of 2025, while the freight share in the C&F China price dropped from 36.7% to 25.8%.

Aussie iron ore: weight of freight in CFR China price in 2023-2025

Aussie iron ore: weight of freight in CFR China price in 2023-2025

Colombian coal: weight of freight in CFR Turkey price in 2023-2025

Colombian coal: weight of freight in CFR Turkey price in 2023-2025