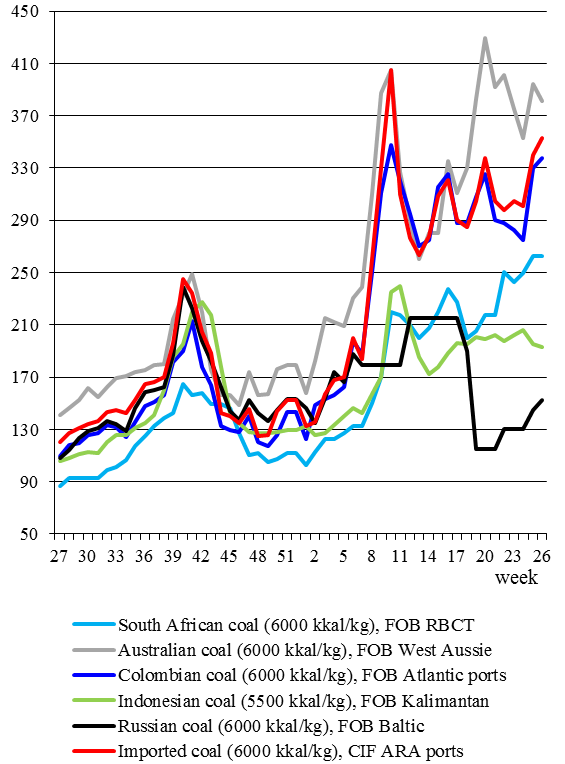

Coal export and import prices // week 26

04.07.2022 16:45

Coal price dynamics, $/tonne

Coal price dynamics, $/tonne

|

|

July 1

|

June 24

|

w-o-w

|

|

Thermal coal, $/tonne

|

|

|

|

|

export*

|

|

|

|

|

Russian coal, FOB Riga

|

145 - 160

|

140 - 150

|

+7.5

|

|

Russian coal, FOB Vostochny

|

185 - 195

|

190 - 195

|

-2.5

|

|

Indonesian coal**, FOB S.Kalimantan

|

190 - 196

|

190 - 200

|

-2

|

|

Colombian coal*, FOB Atlantic coast

|

320 - 355

|

310 - 350

|

+7.5

|

|

South Africa, FOB Richards Bay

|

325 - 340

|

305 - 345

|

+7.5

|

|

Australia, FOB Newcastle

|

372 - 390

|

380 - 408

|

-13

|

|

import

|

|

|

|

|

Europe*, CIF ARA

|

350 - 355

|

321 - 358

|

13

|

|

Japan*, CIF East Coast of Japan

|

170 - 185

|

170 - 185

|

=

|

|

China**, C&F northern ports

|

172 - 210

|

174 - 215

|

-3.5

|

|

Coking coal, $/tonne

|

|

|

|

|

export

|

|

|

|

|

Australia, FOB Gladstone

|

285 - 320

|

350 - 378

|

-61.5

|

|

USA, FOB Norfolk

|

320 - 335

|

340 - 355

|

-2.5

|

* - 6000-6300 kcal/kg coal

** - 5500 kcal/kg coal

*** - coal of ranks Zh

In West Europe, quotes for imported thermal coal have risen by $13/t on average to $350-355/t CIF ARA. This week, the deal for the supply of 50,000 t of coal in Aug has been signed at $376/t DES ARA. Market participants have also reported the contract for a coal stem with shipment in Sep, but no price details have been disclosed.

In Türkiye, prices for Russian coal have stayed within $170-185/t CIF, while quotes for Colombian coal have grown by $20/t to $350-370/t CIF. Spot trade remains dead, but Türkiye is now actively using imported coal: the use has doubled at local TPPs.

Australian coal quotes have dropped to $372-390/t FOB Newcastle ($13/t down); trade is rather slack. This week, one 25,000 t lot of coal with shipment in Aug has been sold at $377.5/t FOB Newcastle.

Prices for South African coal have added $7.5/t to $325-340/t FOB Richards Bay. No signed deals have been reported over the week.