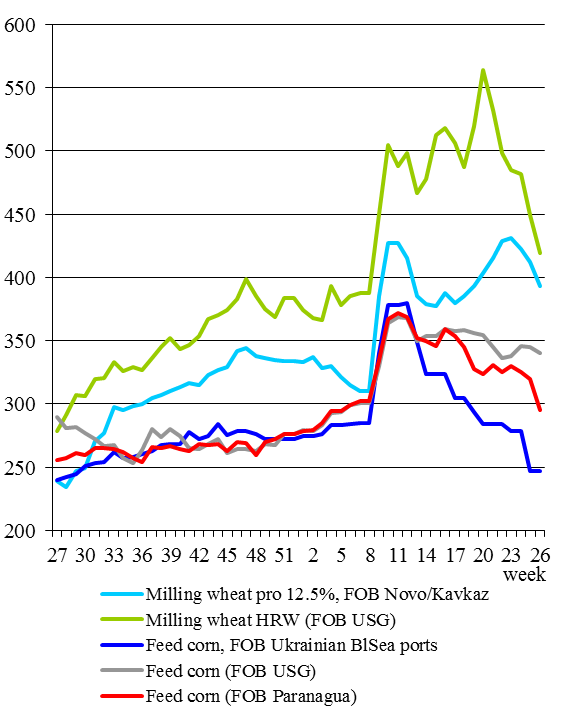

Grain price dynamics, $/tonne

Grain price dynamics, $/tonne

Export prices for grain, $/tonne*

|

|

July 1

|

June 24

|

w-o-w

|

|

Ukraine

|

|

|

|

|

Milling wheat grade 2, FOB

|

405 - 410

|

405 - 430

|

-10

|

|

Milling wheat grade 3, FOB

|

400 - 405

|

400 - 425

|

-10

|

|

Feed wheat, FOB

|

350 - 360

|

350 - 380

|

-10

|

|

Feed barley, FOB

|

360 - 380

|

370 - 390

|

-10

|

|

Feed corn, FOB**

|

230 - 235

|

246 - 248

|

-14.5

|

|

Russia

|

|

|

|

|

Milling wheat pro 12.5%, FOB Black Sea ports

|

388 - 398

|

405 - 420

|

-19.5

|

|

Milling wheat pro 12.5%, FOB Azov Sea ports

|

370 - 375

|

395 - 398

|

-24

|

|

Milling wheat pro 11.5%, FOB Black Sea ports

|

375 - 394

|

410 - 422

|

-31.5

|

|

Feed barley, FOB Azov Sea ports

|

330 - 335

|

350 - 363

|

-24

|

|

Kazakhstan**

|

|

|

|

|

Wheat grade 3, DAP Saryagash

|

430 - 440

|

445 - 450

|

-17.5

|

|

Feed barley, FOB Aktau port

|

-

|

455 - 460

|

-

|

|

Wheat grade 3, FOB Aktau port

|

-

|

370 - 380

|

-

|

|

Europe

|

|

|

|

|

Milling wheat 76/220/11, FOB Rouen

|

387 - 394

|

400 - 418

|

-23.5

|

|

Milling wheat, FOB Germany

|

390 - 408

|

405 - 420

|

-13.5

|

|

Milling wheat, FOB Constanta

|

390 - 405

|

400 - 415

|

-10

|

|

Feed barley, FOB Hamburg / Rostock

|

340 - 360

|

354 - 378

|

-16

|

|

Feed barley, FOB Rouen / La Pallice

|

350 - 355

|

360 - 365

|

-10

|

|

USA

|

|

|

|

|

Milling wheat HRW (FOB US Gulf)

|

412 - 426

|

433 - 465

|

-30

|

|

Milling wheat SRW (FOB US Gulf)

|

337 - 359

|

362 - 400

|

-33

|

|

Feed corn (FOB US Gulf)

|

334 - 346

|

339 - 351

|

-5

|

|

South America

|

|

|

|

|

Milling wheat pro 11.5%, FOB UpRiver

|

448 - 467

|

462 - 495

|

-21

|

|

Feed corn, FOB UpRiver

|

255 - 288

|

279 - 308

|

-22

|

|

Feed corn, FOB Paranagua

|

281 - 309

|

311 - 329

|

-25

|

|

Australia

|

|

|

|

|

Milling wheat, FOB Albany**

|

303 - 310

|

301 - 320

|

-4

|

|

Milling wheat, FOB Albany

|

312 - 327

|

325 - 338

|

-12

|

|

Milling wheat, FOB Kwinana**

|

300 - 310

|

300 - 317

|

-3.5

|

|

Milling wheat, FOB Kwinana

|

310 - 327

|

323 - 340

|

-13

|

|

Milling wheat, FOB Port Lincoln**

|

331 - 332

|

320 - 327

|

8

|

|

Milling wheat, FOB Port Lincoln

|

330 - 336

|

327 - 342

|

-1.5

|

|

Feed barley, FOB Albany**

|

256 - 276

|

265 - 269

|

-1

|

|

Feed barley, FOB Albany

|

258 - 271

|

272 - 279

|

-11

|

|

Feed barley, FOB Kwinana**

|

261 - 279

|

265 - 269

|

3

|

|

Feed barley, FOB Kwinana

|

261 - 272

|

268 - 279

|

-7

|

|

Feed barley, FOB Port Lincoln**

|

284 - 285

|

307 - 312

|

-25

|

|

Feed barley, FOB Port Lincoln

|

281 - 283

|

283 - 298

|

-8.5

|

* - offer price,

** - grain of the old crop

Export prices for oilseeds, $/tonne*

|

|

July 1

|

June 24

|

w-o-w

|

|

USA

|

|

|

|

|

Soybeans, FOB US Gulf

|

643 - 654

|

629 - 673

|

-2.5

|

|

South America

|

|

|

|

|

Soybeans, FOB UpRiver

|

614 - 629

|

606 - 656

|

-9.5

|

|

Soybeans, FOB Paranagua

|

627 - 637

|

611 - 661

|

-4

|

* - offer price,

** - grain of the old crop

Ukraine'

s grain export market remains paralyzed due to the ongoing Russian-Ukrainian war. All country’s ports in the Black and Azov Seas are blocked, vessel calls are impossible, and new contracts on the FOB basis have not been concluded. Indicative prices for wheat and barley shipped from Black Sea ports have dropped by $10/t on average to $405-410/t FOB (grade 2 wheat), $400-405/t FOB (grade 3 grain), $350-360/t FOB (feed wheat) and $360-380/t FOB (barley). Quotes suffer pressure from the lack of sales, the absence of decisions regarding port de-blockade, low export pace via the Danube ports and by rail. Moreover, reports about good crop state, the start of harvesting and lower domestic prices have also pushed export quotes down. Prices for corn have fallen by $14.5/t to $230-235/t FOB Black Sea. In the Danube ports, quotes have also declined to about $240/t FOB, while bid prices vary within $225-235/t FOB. Prices for feed corn have been decreasing also on the western borders of Ukraine. Thus, quotes at the border with Poland have dropped by $10/t to $210-225/t DAP, while those at the border with Hungary are voiced at $215-230/t DAP. Early grain and leguminous crops have been already harvested on an area of 131,500 hectares (1% of the plan): farmers have harvested 248,400 t of barley and 39,400 t of wheat.

In the season 2021-22, Ukraine exported 48.5 mln t of grain and leguminous crops (almost 4 mln t more compared to the previous season). In particular, exports amounted to 23.5 mln t of corn, 18.7 mln t of wheat and 5.7 mln t of barley. Note that June exports reached 1.4 mln t (vs. 2.6 mln t in June 2021): 1.2 mln t of corn (2 mln t), 143,000 t of wheat (500,000 t) and 36,000 t of barley (50,000 t).

Prices for

Russian

grains have declined amid progressing harvesting, still record wheat harvest forecasts this season and quite large volumes of old crop grain remaining at farmers’ stocks in the south of the country (let alone supplies of stolen Ukrainian grain). Prices were also affected by the revision of the export duty calculating principle as the country’s Agriculture Ministry started to calculate it in rubles. Thus, for the period of July 6-13, the export duty on wheat was set at ₽4,600/t, that for barley at ₽3,307/t, for corn at ₽2,168.8/t. At the same time, importers’ demand is weak despite the Black Sea market picture (especially compared to previous years). Most likely, this is due to sanctions against Russian banks and insurance risks when entering the waters of the Black and Azov Seas. This week, 12.5% protein wheat is offered at $388-398/t FOB Black Sea ($19.5/t down) and $370-375/t FOB Azov Sea ($24/t down), while 11.5% protein grain is quoted at $375-394/t FOB Black Sea ($31.5/t down), barley at $330-335/t FOB Black Sea ($24/t down). Note that the price decline could have been more significant if not for the ruble strengthening against the dollar. This week, SovEcon has raised its forecast for Russian wheat exports in MY 2022-23 to a record 42.6 mln t (+300,000 t to the previous estimate).

Grain trade has been slack in

Kazakhstan

, with some sporadic deals signed only for wheat with delivery to Central Asian countries. Recall that from July 1 to Sep 30, the wheat export quota was set at 550,000 t. At the same time, quotes have dropped by $17.5/t to $430-440/t DAP Saryagash and importers push for bigger concessions, expecting a decline to $400/t DAP Saryagash. No barley offers have been reported this week.

Quotes for

EU

grains have also shown a significant decline this week. Wheat prices have dropped to $387-394/t FOB Rouen ($23.5/t down), $390-408/t FOB German ports ($13.5/t down) and $390-405/t FOB Constanta ($10/t down). Barley is offered at $340-360/t FOB Rouen/La Pallice ($16/t down) and $350-355/t FOB Hamburg/Rostock ($10/t down). Traders are actively making concessions in order to attract importers, especially given the fact that major buyers have again launched international tenders this week. Quotes suffer additional pressure from higher harvesting pace in key exporting countries. Thus week, Egyptian GASC has purchased 825,000 t of wheat, including 240,000 t of Romanian grain bought at $429.9-432.6/t C&F, 360,000 t of French wheat at $432.7-439.8/t and 50,000 t of Bulgarian grain at $432.7/t C&F. Jordan has bought 60,000 t of milling wheat at $445/t C&F and has launched a tender for the purchase of another 120,000 t of milling wheat. Algerian OAIC has purchased about 740,000 t of wheat at $445/t C&F with shipments in Aug from Europe or in July from South America or Australia. Meanwhile, grain harvesting continues in France: as of June 20, local farmers have processed about 2% of wheat and 26% of barley fields.

During the period started July 1 and ended June 26, the EU traders exported 27.1 mln t of wheat (vs. 25.6 mln t in the same period last season), 6.8 mln t of barley (7.3 mln t) and 5.7 mln t of corn (2.89 mln t). At the same time, corn imports reached 16.2 mln t (15 mln t). During June 20-26, exports amounted to 170,600 t of wheat (including 54,800 t from France, 46,000 t from Finland, almost 40,000 t from Germany and 29,500 t from Poland), 15,000 t of corn (11,300 t from Poland) and 1,400 t of barley (about 1,000 t from France).

In the USA, corn prices have dropped by $5/t to $334-346/t FOB Gulf of Mexico amid increased planting area estimate. The USDA published its report on acreage and reserves, estimating the corn planting area at 89.92 mln acres (analysts' average estimate is 89.86 mln acres), which is 0.43 mln acres more than Mar forecasts, but 4% less than last year. Wheat prices suffer pressure from the harvesting campaign. Thus, HRW is offered at $412-426/t FOB Gulf of Mexico ($30/t down), SRW at $337-359/t FOB Gulf of Mexico ($33/t down). Harvesting of winter wheat is 41% complete vs. 31% last year and a five-year average of 35%. Similar to the last week, 30% of crops are in good/excellent state vs. 48% last year. Wheat planting area is estimated at 47.09 mln acres (analysts' average estimate is 47.02 mln acres), down 0.26 mln acres from Mar forecast and up 1% from last year. The estimate of soybean planting area was cut by 2.63 mln acres from the Mar estimate to 88.33 mln acres (analysts' average estimate is 90.45 mln acres), up 1% from last year. Despite this fact, oilseed quotes have dropped by $2.5/t to $643-654/t FOB Gulf of Mexico under pressure from wheat and corn markets. The soybean planting is 98% complete vs. 99% as of the same date last year and a five-year average of 97%. The state of soybean and corn crops has worsened by 3% over the week, with 65% of soybeans (60% last year) and 67% of corn (64%) estimated to be in good/excellent state.

In June 17-23, the US exporters sold 500,700 t of wheat, 479,400 t of corn (including 119,300 t of new crop grain) and 401,100 t of soybeans (127,600 t of new crop oilseeds). The Philippines purchased the largest volume of wheat (68,000 t), while Japan became the major corn buyer (191,900 t); the largest soybean stem was sold to the Netherlands (149,000 t). At the same time, importers cancelled the previously purchased 393,600 t of soybeans, 271,300 t of corn, and 4,000 t of wheat.

During the same period, traders shipped 1.2 mln t of corn (vs. 1.1 mln t supplied in the previous week), 517,700 t of soybeans (494,100 t) and 241,400 t of wheat (336,300 t). Large volumes of corn were shipped to Japan (425,900 t), Mexico (296,300 t) and China (207,700 t). As for soybeans, 149,000 t were supplied to the Netherlands and 93,500 t to China. The Philippines will receive the largest volume of wheat, 65,500 t.

As safrinha corn is being harvested in Brazil, relevant export quotes are declining ($25/t down to $281-309/t FOB Paranagua). As of June 25, harvesting was 20.4% complete. Note that farmers report the lack of space to store grain in some producing regions. Increased production estimates are also putting pressure on prices. Thus, AgRural has raised its 2021/22 corn production estimate by 1.5 mln t to 113.8 mln tons. In turn, Datagro estimates the harvest at 116.1 mln t vs. the previous estimate of 114.35 mln t. Average soybean quotes have dropped by $4/t to $627-637/t FOB Paranagua. Anec estimates June exports of soybeans at 10.15 mln t, those of corn at 1.76 mln t.

From June 25 to July 1, Brazilian traders shipped 1.8 mln t of soybeans (vs. 2.4 mln t supplied during June 18-24) and 625,400 t of corn (500,200 t). Thus, 1.1 mln t of soybeans were shipped to China, 195,000 t to Iran, 141,200 t to Spain and 131,600 t to Thailand. Spain will receive 131,200 t of corn, Japan – 129,300 t, Saudi Arabia – 98,200 t.

Corn harvesting is underway also in Argentina, which puts pressure on quotes ($22/t down to $255-288/t FOB Upriver). Harvesting is 46.5% complete, with 16% of corn crops still estimated to be in good state (vs. 38% last season). Severe drought in the country is still negatively affecting the 2022-23 wheat crop, sowing of which is 73.5% complete. Thus, 24% of crops are in good state vs. 26% last week and 56% last year. New crop 11.5% protein wheat is offered at $372-375/t FOB Upriver. The volume of available old crop grain is decreasing, but relevant prices have dropped by $21/t to $448-467/t FOB Upriver over the week. Soybean quotes have fallen by $9.5/t to $614-629/t FOB Upriver following the global trend. Note that this week’s truckers strike around the port of Rosario (caused by the shortage of fuel) has been hampering the normal port operation.

In June 25-30, Argentine exporters shipped 402,600 t of corn (vs. 791,900 t supplied during June 18-24), 159,800 t of soybeans (57,800 t) and 63,200 t of wheat (123,500 t). Large volumes of corn were shipped to South Korea (69,100 t), Malaysia (57,400 t) and Jordan (50,900 t). The entire volume of soybeans, 159,800 t, was supplied to China. As for wheat, 51,300 t of this grain were shipped to Brazil, 8,600 t to Chile and 3,300 t to Puerto Rico.

The Australian grain export market has been mainly showing price downtrends this week amid growing farmers’ interest to sell both old and new crop grains. Thus, quotes for APW1 wheat in western ports have dropped by $3.5-4/t to $300-310/t FOB Kwinana and $303-310/t FOB Albany, while the south coast has shown an upturn of $8/t to $331-332/t FOB Port Lincoln. Barley is offered at $256-276/t FOB Albany ($1/t down), $261-279/t FOB Kwinana ($3/t up) and $284-285/t FOB Port Lincoln ($25/t down). Logistical problems continue in some parts of Australia. Importers’ demand is still strong, especially from Asian buyers. Meanwhile, stocks of old crop grains already look limited in South Australia.

New crop wheat and barley are quoted at $310-336/t FOB and $258-283/t FOB, respectively.