Mineral fertilizers price dynamics, $/tonne

Mineral fertilizers price dynamics, $/tonne

|

|

July 1

|

June 24

|

w-o-w

|

|

Urea - bulk (spot), $/tonne

|

|

|

|

|

FOB Black Sea (prilled)*

|

530 - 605

|

480 - 540

|

+57.5

|

|

FOB Baltic Sea (prilled)*

|

500 - 550

|

430 - 450

|

85

|

|

FOB Baltic Sea (granular)*

|

460 - 590

|

450 - 540

|

30

|

|

СFR Brazil (granular)*

|

610 - 680

|

570 - 630

|

45

|

|

AN - bulk (spot), $/tonne

|

|

|

|

|

FOB Black Sea*

|

315 - 320

|

369 - 450

|

-92

|

|

FOB Baltic Sea*

|

285 - 295

|

350 - 410

|

-90

|

|

CFR Brazil

|

385

|

450 - 500

|

-90

|

|

AS - bulk (spot), $/tonne

|

|

|

|

|

(white) FOB Black Sea* / Baltic Sea*

|

196 - 219

|

196 - 219

|

=

|

|

(white) CFR Turkey* (180-days credit)

|

286 - 300

|

276 - 290

|

10

|

|

UAN - 32%, $/tonne

|

|

|

|

|

FOB Black Sea**

|

660 - 704

|

660 - 704

|

=

|

|

FOB Baltic Sea**

|

662 - 703

|

662 - 703

|

=

|

|

DAP - bulk (spot), $/tonne

|

|

|

|

|

FOB Baltic Sea*

|

785 - 807

|

785 - 807

|

=

|

|

FOB Morocco*

|

1,100 - 1,130

|

1,115 - 1,262

|

-73.5

|

|

CFR India*

|

920 - 930

|

920 - 930

|

=

|

|

МАP - bulk (spot), $/tonne

|

|

|

|

|

FOB Morocco*

|

967 - 1,002

|

967 - 1,032

|

-15

|

|

FOB Baltic Sea*

|

894 - 965

|

894 - 990

|

-12.5

|

|

CFR Brazil

|

1,025 - 1,030

|

1,000 - 1,060

|

-2.5

|

|

Ammonia (spot/contract), $/tonne

|

|

|

|

|

FOB Pivdenny

|

no trade

|

no trade

|

-

|

|

FOB Baltic Sea

|

no trade

|

no trade

|

-

|

|

CFR Tampa

|

960

|

1

|

-40

|

|

MOP - bulk (spot/contract), $/tonne

|

|

|

|

|

FOB Baltic Sea (standard)*

|

530 - 915

|

530 - 915

|

=

|

|

FOB Baltic Sea (granular)*

|

920 - 1,055

|

915 - 1,050

|

5

|

|

FOB Vancouver (standard)*

|

510 - 905

|

510 - 905

|

=

|

|

FOB Vancouver (granular)*

|

910 - 1,010

|

980 - 1,010

|

-35

|

|

CFR Brazil (granular)*

|

1,100 - 1,150

|

1,130 - 1,150

|

-15

|

|

CFR Southeast Asia (standard, granular)

|

1,050 - 1,150

|

900 - 1,125

|

+87.5

|

|

NPK 16-16-16 - bulk (spot), $/tonne

|

|

|

|

|

FOB Baltic Sea*

|

590 - 600

|

590 - 600

|

=

|

|

Sulphur - dry bulk (spot), $/tonne

|

|

|

|

|

FOB Black Sea*

|

300 - 400

|

300 - 400

|

=

|

|

FOB Baltic Sea*

|

250 - 350

|

250 - 350

|

=

|

|

FOB Vancouver*

|

410 - 420

|

470 - 490

|

-65

|

|

FOB Middle East*

|

420 - 430

|

420 - 440

|

-5

|

|

CFR China*

|

400 - 440

|

470 - 480

|

-55

|

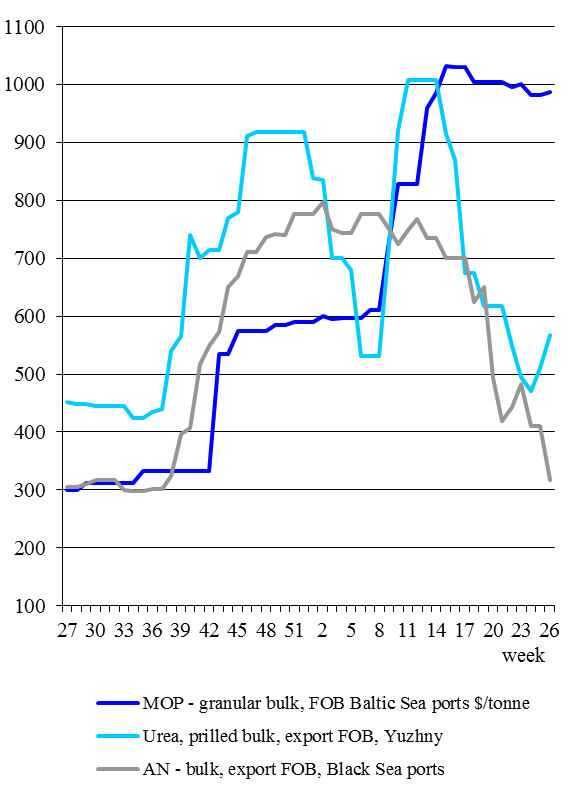

Urea

suppliers continue to raise prices, although, similar to traders and many importers, they have not signed any new deals in the last week of June, expecting another Indian tender. North African producers offer granular urea at $765-800/t FOB Egypt ($48/t up over the week) and about $760/t FOB Algeria ($13/t up), while indicative prices for Russian fertilizer amount to $460-590/t FOB Baltic Sea ($30/t up). Azerbaijani and Turkmen granular urea is offered at $640/t FOB Georgia ($75/t up). Prilled urea is quoted at $500-550/t FOB Baltic ports ($85/t up) and $530-605/t FOB Black Sea ports ($58/t up). In Brazil, recent granular urea sales were made at $610-680/t CFR depending on origin, which is $40-50/t higher compared to last week. Meanwhile, supplies of slightly cheaper Russian urea led to some widening of the US price range, to $553-579/t FOB New Orleans vs. $568-573/t FOB as of last week.

Unlike urea, quotes for Russian

ammonium nitrate

continue to fall rapidly. In particular, AN was sold to Brazil at $385/t CFR ($90/t down over the week), which is equivalent to $285-295/t FOB Baltic Sea and $315-320/t FOB Black Sea. No offers of Georgian ammonium nitrate have been reported this week as repairs continue at Rustavi Azot. Meanwhile, French consumers show increased demand for ammonium nitrate amid growing gas prices at European hubs and rising quotes for urea. Yara and Borealis reported that they had completely sold out the volumes with July and Aug shipments at €775-790/t CPT distributors (bulk).

Unchanged price dynamics can be seen on the

phosphate fertilizer

market. Brazilian demand for MAP remains weak, but players expect 30% of the stock to be sold before planting starts in late Aug, and these bulk purchases are projected to push prices up. Recently, Brazilian importers were purchasing 12:52 Russian MAP and 11:52 Moroccan MAP at $1025-1030/t CFR Brazil, while Chinese 11:52 MAP was bought at about $1,000/t CFR Brazil. Note that in order to increase its share on the Latin American market, the Moroccan OCP plans to build a new plant in Guatemala, and its commissioning will significantly reduce transportation costs to regional consumers. In late June, Moroccan OCP was offering DAP to European consumers at $1,100/t FOB Morocco with shipments in July. Quotes for Russian-origin DAP have stayed at $785-807/t FOB Baltic Sea due to the lack of new deals.

Within the tender closed on June 9, Bangladeshi Agriculture Ministry purchased 812,000 t of DAP at $1,019-1,030/t CFR and 250,000 t of TSP at $1,032-1,045/t CFR Bangladesh. According to ISM sources, the importer will receive 200,000 t of DAP from Jordan, 160,000 t from Tunisia, while the rest of the volume will be shipped from China. At the end of the week, Indian NFL also closed its tender for the purchase of 100,000 t of DAP in bulk, but results have not been disclosed so far. Market players note that Moroccan OCP has stopped publishing quarterly prices for phosphoric acid with shipments to India. From now on, the parties can keep the contract details confidential. CIL is going to sign the agreement with Jordanian JPMC for the supply of phosphoric acid and DAP in Q-4 2022 or 2023, but the exact date of the contract has not yet been determined.

Closer to June 15, quotes for

potassium chloride

have shown an upturn in SE Asia and Brazil, leading to increased prices in supplying regions. By contrast prices for US granular fertilizer have decreased, while quotes hold steady in the European countries. Despite low consumer activity on the world market, producers keep prices for potash fertilizers high due to the shortage of volumes. For example, Canpotex and APC sold fine to Indonesian Pupuk at $1,125/t CFR Indonesia with shipments in second half of the year, which pushed weighted average prices in SE Asia up to $1,050-1,100/t CFR (vs. $900-950/t CFR SE Asia at the beginning of summer). Vietnam and Thailand are now in the middle of the buying season, but demand for potassium chloride is minimal. Granular fertilizers with shipments in Q3 are offered at $1,100-1,150/t CFR Thailand/Vietnam, which is probably too expensive for importers.

In mid-June, suppliers were trying to sell fertilizers in North-West Europe at €1,000/t CFR, but no deals were signed at this level, with the last known volumes sold at best at €850-900/t CFR North-West Europe (quotes were staying within this range for more than two months). Players assume that given high prices, regional companies may reduce consumption of potash fertilizers or refuse from purchasing. In turn, distributors do not hurry to accumulate granular fertilizers at stocks, expecting quotes to drop if Uralkali and Belaruskali spur shipments from Russian ports. According to market participants, during June 1-26, Belaruskali managed to ship 4,031 t of potassium chloride to India from the Russian port of Pravy Bereg (an internal port located in Astrakhan) and 4,230 t to China from the port of Nakhodka-Vostochnaya. Note, however, that in June, producers planned to supply 36,000 t of fertilizers from Belarus to India and 30,000 t to China.