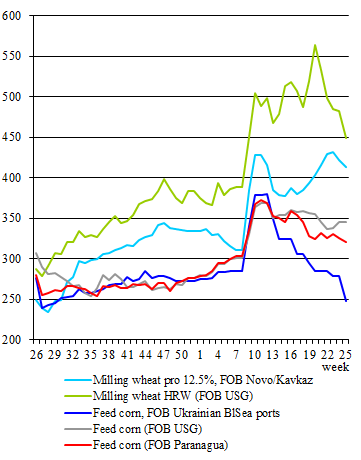

Grain price dynamics, $/tonne

Grain price dynamics, $/tonne

|

|

June 24

|

June 17

|

w-o-w

|

|

Ukraine

|

|

|

|

|

Milling wheat grade 2, FOB

|

405 - 430

|

415 - 440

|

-10

|

|

Milling wheat grade 3, FOB

|

400 - 425

|

410 - 435

|

-10

|

|

Feed wheat, FOB

|

350 - 380

|

370 - 400

|

-20

|

|

Feed barley, FOB

|

370 - 390

|

-

|

-

|

|

Feed corn, FOB**

|

246 - 248

|

278 - 280

|

-32

|

|

Russia

|

|

|

|

|

Milling wheat pro 12.5%, FOB Black Sea ports

|

405 - 420

|

415 - 430

|

-10

|

|

Milling wheat pro 12.5%, FOB Azov Sea ports

|

395 - 398

|

407 - 419

|

-16.5

|

|

Milling wheat pro 11.5%, FOB Black Sea ports

|

410 - 422

|

415 - 430

|

-6.5

|

|

Feed barley, FOB Azov Sea ports

|

350 - 363

|

357 - 379

|

-11.5

|

|

Kazakhstan**

|

|

|

|

|

Wheat grade 3, DAP Saryagash

|

445 - 450

|

445 - 450

|

=

|

|

Feed barley, FOB Aktau port

|

455 - 460

|

455 - 460

|

=

|

|

Wheat grade 3, FOB Aktau port

|

370 - 380

|

370 - 380

|

=

|

|

Europe

|

|

|

|

|

Milling wheat 76/220/11, FOB Rouen

|

400 - 418

|

413 - 420

|

-7.5

|

|

Milling wheat, FOB Germany

|

405 - 420

|

423 - 440

|

-19

|

|

Milling wheat, FOB Constanta

|

400 - 415

|

400 - 415

|

=

|

|

Feed barley, FOB Hamburg / Rostock

|

354 - 378

|

365 - 385

|

-9

|

|

Feed barley, FOB Rouen / La Pallice

|

360 - 365

|

370 - 375

|

-10

|

|

USA

|

|

|

|

|

Milling wheat HRW (FOB US Gulf)

|

433 - 465

|

478 - 486

|

-33

|

|

Milling wheat SRW (FOB US Gulf)

|

362 - 400

|

407 - 416

|

-30.5

|

|

Feed corn (FOB US Gulf)

|

339 - 351

|

343 - 348

|

-0.5

|

|

South America

|

|

|

|

|

Milling wheat pro 11.5%, FOB UpRiver

|

462 - 495

|

466 - 495

|

-2

|

|

Feed corn, FOB UpRiver

|

279 - 308

|

298 - 304

|

-7.5

|

|

Feed corn, FOB Paranagua

|

311 - 329

|

324 - 327

|

-5.5

|

|

Australia

|

|

|

|

|

Milling wheat, FOB Albany**

|

301 - 320

|

345 - 350

|

-37

|

|

Milling wheat, FOB Albany

|

325 - 338

|

358 - 364

|

-29.5

|

|

Milling wheat, FOB Kwinana**

|

300 - 317

|

334 - 339

|

-28

|

|

Milling wheat, FOB Kwinana

|

323 - 340

|

358 - 364

|

-29.5

|

|

Milling wheat, FOB Port Lincoln**

|

320 - 327

|

410 - 416

|

-89.5

|

|

Milling wheat, FOB Port Lincoln

|

327 - 342

|

369 - 374

|

-37

|

|

Feed barley, FOB Albany**

|

265 - 269

|

282 - 287

|

-17.5

|

|

Feed barley, FOB Albany

|

272 - 279

|

293 - 297

|

-19.5

|

|

Feed barley, FOB Kwinana**

|

265 - 269

|

282 - 287

|

-17.5

|

|

Feed barley, FOB Kwinana

|

268 - 279

|

293 - 297

|

-21.5

|

|

Feed barley, FOB Port Lincoln**

|

307 - 312

|

307 - 311

|

+0.5

|

* - offer price,

** - grain of the old crop

Export prices for

Ukrainian

grains are sliding down. Thus, quotes still suffer pressure from large number of domestic offers (farmers seek to empty warehouses at the start of harvesting) and the lack of progress on de-blockade of Ukrainian ports. Indicative prices for grade 2 wheat are voiced at $405-430/t FOB Black Sea ($10/t down), those for grade 3 grain at $400-425/t FOB Black Sea ($10/t down), for feed wheat at $350-380/t FOB Black Sea ($20/t down), for corn at $246-248/t FOB Black Sea ($32/t down), for barley at $370-390/t FOB Black Sea. In Ukraine’s Danube ports of Reni and Izmail, bids for feed corn have dropped to $250-260/t FOB ($10/t down). According to official data as of June 24, Ukraine exported slightly more than 48 mln t of grain and leguminous crops during this season (including 23.2 mln t of corn, 18.7 mln t of wheat and 5.7 mln t of barley); June shipments are estimated at 1 mln t (915,000 t of corn, 89,000 t of wheat and 23,000 t of barley). In the meantime, farmers have begun harvesting early grain and leguminous crops in Odesa and Nikolayev regions. Thus, they have already processed 42,200 hectares of fields, harvesting 90,000 t of winter barley and 2,000 t of wheat.

Export quotes for

Russian

grains have been rapidly falling this week. Thus, quotes for 12.5% protein wheat have dropped to $405-420/t FOB Black Sea ($10/t down) and $395-398/t FOB Azov Sea ($16.5/t down). 11.5% protein wheat is offered at $410-422/t FOB Black Sea ($6.5/t down), barley at $350-363/t FOB Black Sea ($11.5/t down). Prices suffer pressure from weak importers’ demand, an upturn in wheat harvest estimate to a new record level and a revision of export duties. Even the

tender

for the purchase of 500,000 t of wheat launched by the Trading Corporation of Pakistan (TCP) has not supported prices. Reportedly, Bangladesh is also trying to buy at least 200,000 t of Russian wheat within an intergovernmental agreement after an export ban was introduced in India (the country's largest supplier of grain). This week, SovEcon has raised its forecast for Russia's wheat harvest this year by 600,000 t to a new record-high of 89.2 mln t. At the same time, the Russian government is discussing the possibility of revising the formula for determining the grain export duty due to the need to switch to ruble payments in foreign trade. Earlier, Russian agricultural producers repeatedly spoke about the need to cancel the duty as besides lower domestic prices, the duty leads to a profitability decline for farmers amid rising costs. In the meantime, starting June 29, the export duty on wheat will be set at $146.1/t (vs. the current $142/t), that for barley at $117.5/t.

No major shifts can be seen on the

Kazakh

grain export market: trade is slack, while prices are not decreasing. Grade 3 wheat is offered at $455-460/t FOB Aktau and $445-450/t DAP Saryagash, barley at $370-380/t FOB Aktau. Kazakh traders temporarily got the opportunity to export wheat without selling 10% of the volume to the Food Corporation at a reduced price. As specified, this rule is valid from June 15 (quota expiration date) until the entry into force of a new quota order, which is expected in early July.

According to traders, the process of phytosanitary certificate approval in the Kazakh Agriculture Ministry takes no more than three days.

Export quotes for

EU

grains have also dropped this week despite some increase in importers’ activity. Thus, wheat is offered at $400-418/t FOB Rouen ($7.5/t down), $405-420/t FOB German ports ($195/t down) and $400-415/t FOB Constanta (unchanged). Barley is quoted at $354-378 /t FOB Rouen/La Pallice ($9/t down) and $360-365/t FOB Hamburg/Rostock ($10/t down). Several traditional buyers have launched tenders this week, however this fact has not supported prices given the market situation. Thus, Jordan has bought 120,000 t of feed barley at $407/t C&F with shipments in Oct-Nov. Tunisian ODC has purchased 100,000 t of wheat and 50,000 t of feed barley for shipments during July 20 - Aug 15. Algerian OAIC has bought 600,000 t of milling wheat at $445/t C&F for July-Aug shipments. Saudi Arabian SAGO has launched a tender for the purchase of 488,000 t of wheat for shipments in Nov-Jan.

During July 1 - June 19, the EU countries exported 26.7 mln t of wheat (vs. 25.5 mln t in the same period of the previous season), 6.8 mln t of barley (7.3 mln t) and 5.7 mln t of corn (2.7 mln t). Corn imports reached 16 mln t (14.9 mln t). During June 13-19, exports of EU grains amounted to 366,800 t of wheat (including 110,700 t from France, 62,700 t from Bulgaria, 62,000 t from Germany, 58,000 t from Lithuania, 39,400 t from Poland and 32,500 t from Romania), 8,800 t of corn (4,400 t from Poland and 3,200 t from France) and 2,600 t of barley (1,700 t from Hungary).

Expectations of a global recession have spurred traders' fears about global demand, leading to a sharp decline in prices for agri products.

In the

US

, quotes for HRW and SRW wheat have fallen by $33/t to $433-465/t FOB Gulf of Mexico and $30.5/t to $362-400/t FOB Gulf of Mexico, respectively. Weather forecasts have improved, putting further pressure on prices. Soybean quotes have dropped by $23.5/t to $629-673/t FOB Gulf of Mexico. Corn is offered at $339-351/t FOB Gulf of Mexico ($0.5/t down).

Harvesting of winter wheat is 25% complete (vs. 15% last year and a five-year average of 22%). Also, 30% of wheat crops are in good/excellent state (vs. 31% last week and 49% last year). Soybean planting is 94% complete vs. 97% last season and a five-year average of 93%. Over the week, the state of soybean and corn crops has worsened by 2%, with 68% of oilseed and 70% of corn crops estimated to be in good/excellent state (60% and 65%, respectively, as of the same date last year).

In June 10-16, US exporters sold 1.1 mln t of corn (including 358,400 t of new crop grain), 520,900 t of wheat and 395,400 t of soybeans (271,600 t of new crop oilseeds). Mexico and Japan became the main buyers of corn and wheat. Thus, Mexican importers purchased 612,500 t of corn (including 137,500 t of new crop grain), while Japanese consumers bought 164,100 t (5,500 t). Each of these importers also purchased 163,900 t of wheat. Largest volumes of soybeans were sold to Costa Rica (75,500 t of new crop oilseeds) and China (6,300 t of old and 66,000 t of new crop soybeans). At the same time, buyers cancelled the previously purchased 101,000 t of soybeans (6,600 t of new crop), 77,300 t of corn and 43,100 t of wheat.

During the same period, US traders shipped 1.1 mln t of corn (vs. 1.4 mln t as of the previous week), 494,100 t of soybeans (708,700 t) and 336,300 t of wheat (370,100 t). Large corn volumes were supplied to China (338,600 t), Mexico (258,800 t) and Japan (246,500 t). 121,500 t of soybeans were also shipped to Mexico, 105,200 t - to Egypt. The largest volume of wheat was supplied to the Philippines (132,700 t).

Prices for

Brazilian

corn and soybeans have decreased to $311-329/t FOB Paranagua ($5.5/t down) and $611-661/t FOB Paranagua ($24/t down), respectively. According to Conab, safrinha corn harvesting was 11% complete as of June 18, which is 4% ahead of last year's pace. This week, Agroconsult analysts have raised their safrinha production estimates from 87.6 mln t to 89.3 mln t, while the corn export forecast has been increased to 43 mln t vs. the previous estimate of 37 mln t. The company has also raised its soybean production estimate from 124.6 mln t to 126.9 mln t due to the increase in planted area. Meanwhile, Anec has lowered its June soybean export forecast to 10.79 mln t (vs. last week’s estimate of 10.84 mln t). Note that Chinese importers are buying less Brazilian soybeans compared to last year. So, May soybean imports from Brazil to

China

amounted to 7.79 mln t vs. 9.23 mln t shipped in May 2021. Meanwhile, May exports of US oilseeds amounted to 1.73 mln t vs. 244,400 t last year. The increase in exports of US soybeans was driven by price gains at a time when quotes for Brazilian products were growing amid adverse weather conditions.

From June 18 to 24,

Brazilian

exporters shipped 2.4 mln t of soybeans (vs. 2.3 mln t supplied during June 11-17) and 500,200 t of corn (327,600 t). Thus, 1.5 mln t of soybeans were shipped to China, 130,900 t to Thailand, 128,500 t to Taiwan and 125,500 t to the Netherlands. Largest volumes of corn were supplied to Iran (219,900 t) and Colombia (99,100 t).

In

Argentina

, soybean quotes have fallen by $23.5/t to $606-656/t FOB Upriver, while corn prices have dropped by $7.5/t to $279-308/t FOB Upriver. Besides the global downtrend, quotes suffer pressure from harvesting. Thus, soybean harvesting is complete, while the total production of the 2021-22 campaign is estimated at 43.3 mln t. Corn harvesting is 42.3% complete, with 16% of crops being in good state (vs. 17% last week and 39% last year). Old crop 11.5% protein wheat is quoted at $462-495/t FOB Upriver ($2/t down). New crop wheat (2022-23 season) is more actively sold at $365-378/t FOB Upriver. Planting of 2022-23 wheat is 61.9% complete. The Buenos Aires Grain Exchange lowered the estimate of planted area by 0.1 mln ha to 6.3 mln ha amid dry conditions. Note that 26% of wheat crops are estimated to be in good state vs. 27% last week and 55% last year.

From June 18 to 24,

Argentine

exporters shipped 791,900 t of corn (vs. 800,600 t supplied during June 11-17) 123,500 t of wheat (33,900 t) and 57,800 t of soybeans (212,000 t). Large volumes of corn were shipped to South Korea (110,400 t), Peru (90,400 t), Egypt (81,400 t) and Chile (81,100 t). Brazil will receive most of the wheat, 88,000 t. The entire volume of soybeans, 57,800 t, was supplied to China.

Despite steadily strong domestic and importers’ demand for

Australian

grain, the global downtrend has put pressure on prices. Thus, APW1 wheat is now offered at $301-320/t FOB Albany ($37/t down), $300-317/t FOB Kwinana ($28/t down) and $320-327/t FOB Port Lincoln ($89.5/t down). In the western ports of Albany and Kwinana, F1 barley is quoted at $265-269/t FOB ($17.5/t down), while prices in Port Lincoln have stayed almost unchanged at $307-312/t FOB ($0.5/t up).

New crop wheat and barley are quoted at $323-342/t FOB and $268-298/t FOB, respectively.