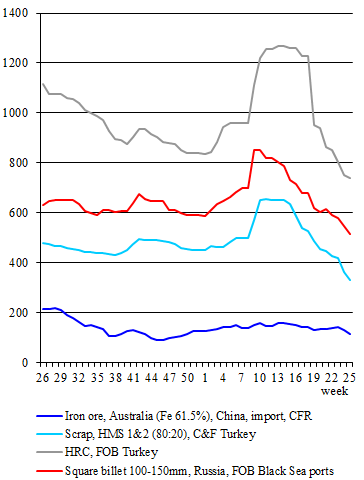

Steels and raw materials price dynamics, $/tonne

Steels and raw materials price dynamics, $/tonne

|

|

June 24

|

June 17

|

w-o-w

|

|

Iron ore fines, $/tonne

|

|

|

|

|

Brazil (Fe 64-65%), C&F China

|

131 - 132

|

140

|

-8.5

|

|

Australia (Fe 61-62%), C&F China

|

112 - 115

|

121 - 135

|

-14.5

|

|

Australia (Fe 58%), C&F China

|

104

|

113 - 114

|

-9.5

|

|

Steel scrap, $/tonne

|

|

|

|

|

Russia, 3A, FOB Baltic Sea

|

234

|

268

|

-34

|

|

Russia, 3A, FOB Far East

|

397 - 413

|

397 - 413

|

=

|

|

Russia, 3A, FOB Black / Azov Sea

|

269 - 274

|

303 - 308

|

-34

|

|

Turkey, HMS 1&2 (80:20), C&F

|

310 - 349

|

345 - 383

|

-34.5

|

|

Japan, HMS 2, FOB

|

380 - 390

|

387 - 400

|

-8.5

|

|

Square billets, $/tonne

|

|

|

|

|

Russia, FOB Black Sea

|

500 - 530

|

535 - 555

|

-30

|

|

Russia, FOB Far East

|

-

|

510 - 540

|

-

|

|

Turkey, FOB

|

580

|

640

|

-60

|

|

Iran, FOB

|

500 - 520

|

550

|

-40

|

|

Slabs, $/tonne

|

|

|

|

|

Russia, FOB Black Sea

|

-

|

535 - 550

|

-

|

|

Brazil, FOB

|

-

|

780 - 800

|

-

|

|

Hot-rolled coils, $/tonne

|

|

|

|

|

Russia, FOB Black Sea

|

665

|

665 - 690

|

-12.5

|

|

Turkey, FOB

|

730 - 750

|

740 - 760

|

-10

|

|

China, FOB

|

680 - 700

|

750 - 770

|

-70

|

|

Rebar, $/tonne

|

|

|

|

|

Turkey (8-32 mm), FOB Mediterranean Sea

|

610 - 660

|

695 - 710

|

-67.5

|

|

Italy (8-32 mm), FOB **

|

680 - 700

|

720 - 740

|

-40

|

|

Spain (8-32 mm), FOB **

|

850 - 880

|

-

|

-

|

* ISM estimates

** - €/tonne

Prices for imported

iron ore

keep going down in China amid excess offer of the raw material on the one hand and muted demand for finished steel products of the domestic production on the other hand. Australian Fe 61-62% iron ore fines are currently offered at $112-115/t C&F (down $14.5/t), while Fe 58% iron ore fines are estimated at $104/t C&F (down $9.5/t). Quotes for Brazilian Fe 64-65% iron ore fines are hovering within $131-132/t C&F (down $8.5/t). Note that iron ore stocks in Chinese ports dropped to an annual minimum of 124.4 million tonnes.

***

Trade remains extremely weak on the Turkish market of imported

steel scrap

due to the ongoing decline in the domestic segment of finished steel products, as well as owing to cheaper imported billets available in the area. Buyers refrain from purchases, insisting on larger price cutbacks. In such circumstances, exporters are trying to find alternative markets to sell scrap at more favorable terms, so, scrap offer in Turkey is not that abundant. Only one deal has been reported this week. A 22,000 t mixed lot of scrap from the Netherlands has been acquired at $318/t C&F Iskenderun; the lot consisted of 19,500 t of HMS 1&2 (75:25) and 2,500 t of bonus scrap.

In South Korea, quotes for Japanese-origin scrap HMS 2 have sagged by $4.5/t to $423-428/t C&F. US-origin HMS 1 is still available at $460-470/t C&F. Russian 3A scrap can be purchased at $440-450/t C&F. No deals or negotiations have been heard of.

***

Export prices for

square billets

from Russia keep doing down amid weak demand in the main sales markets. The offer quotes have plunged by $30/t to $500-530/t FOB Black Sea. Also, billers are available at $550/t C&F North Africa, but buyers are reluctant to accept this price.

Turkish exporters but offer quotes for billets by impressive $60/t to $580/t FOB. However, this price has remained uncompetitive even after the reduction. No fresh contracts have been reported.

Quotes for square billets are sliding down in Southeast Asia. Demand remains muted as buyers are waiting for further price cuts. In the Philippines, Indonesian and Vietnamese billets are offered at $580-610/t C&F Manila. Chinese exporters are ready to sell at $600/t FOB. In Indonesia, Iranian and Russian billets can be purchased at $600/t C&F.

***

Prices for Russian

hot-rolled coils

keep rolling down. At present, the cargo is offered at $665/t FOB Black Sea (down $12.5/t over the week). Demand is almost dead despite the continuing price cuts. Some buying interest has been seen in Asia, with just one deal reported. Thus, up to 35,000 t of Russian HRC with shipment in July were sold at $615/t C&F (the country of destination has not been specified yet).

Chinese HRC exporters cut quotes by $70/t to $680-700/t FOB due to weak domestic demand and government pressure to maintain high production. Note that export offer is limited, since many producers prefer staying out of the market to selling at very low price. Sporadic deals were only reported when selling short. Several small lots averaging to less than 1,000 t each were sold at around $650/t C&F Vietnam.

***

Demand for Turkish

rebar

is muted. This fact together with a downward price trend in the steel scrap segment accelerates pressure on rebar traders.